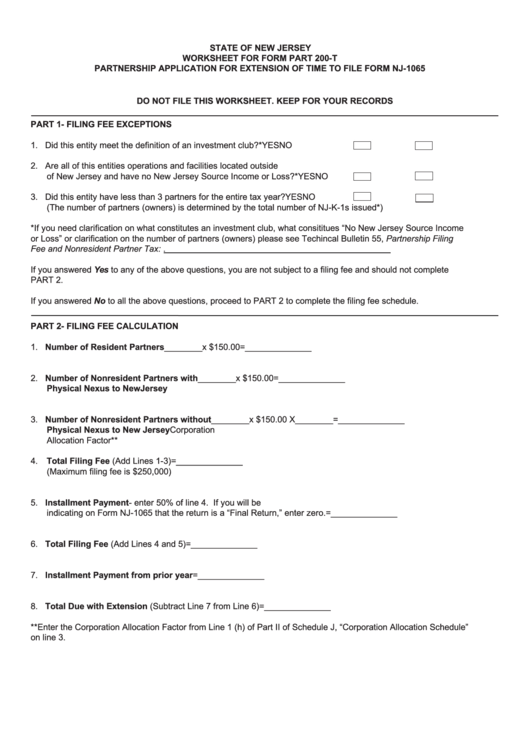

STATE OF NEW JERSEY

WORKSHEET FOR FORM PART 200-T

PARTNERSHIP APPLICATION FOR EXTENSION OF TIME TO FILE FORM NJ-1065

DO NOT FILE THIS WORKSHEET. KEEP FOR YOUR RECORDS

PART 1- FILING FEE EXCEPTIONS

1. Did this entity meet the definition of an investment club?*

YES

NO

2. Are all of this entities operations and facilities located outside

of New Jersey and have no New Jersey Source Income or Loss?*

YES

NO

3. Did this entity have less than 3 partners for the entire tax year?

YES

NO

(The number of partners (owners) is determined by the total number of NJ-K-1s issued*)

*If you need clarification on what constitutes an investment club, what consititues “No New Jersey Source Income

or Loss” or clarification on the number of partners (owners) please see Techincal Bulletin 55, Partnership Filing

Fee and Nonresident Partner Tax: .

If you answered Yes to any of the above questions, you are not subject to a filing fee and should not complete

PART 2.

If you answered No to all the above questions, proceed to PART 2 to complete the filing fee schedule.

PART 2- FILING FEE CALCULATION

1. Number of Resident Partners

________x $150.00

=______________

2. Number of Nonresident Partners with

________x $150.00

=______________

Physical Nexus to NewJersey

3. Number of Nonresident Partners without ________x $150.00 X________

=______________

Physical Nexus to New Jersey

Corporation

Allocation Factor**

4. Total Filing Fee (Add Lines 1-3)

=______________

(Maximum filing fee is $250,000)

5. Installment Payment- enter 50% of line 4. If you will be

indicating on Form NJ-1065 that the return is a “Final Return,” enter zero.

=______________

6. Total Filing Fee (Add Lines 4 and 5)

=______________

7. Installment Payment from prior year

=______________

8. Total Due with Extension (Subtract Line 7 from Line 6)

=______________

**Enter the Corporation Allocation Factor from Line 1 (h) of Part II of Schedule J, “Corporation Allocation Schedule”

on line 3.

1

1