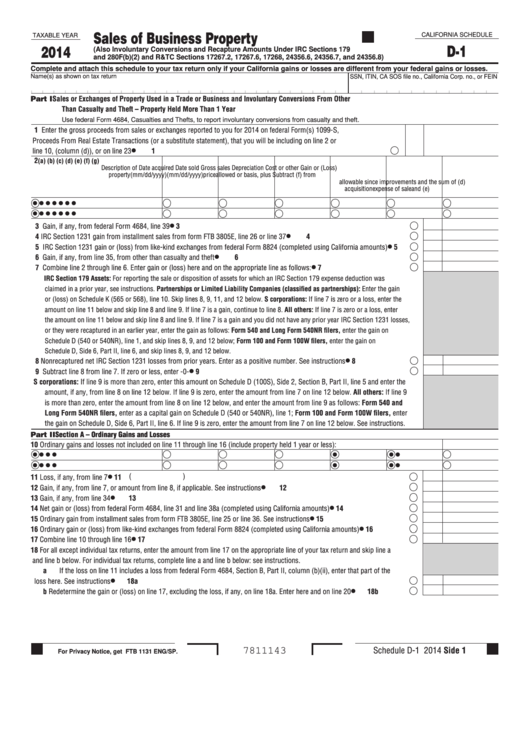

Sales of Business Property

CALIFORNIA SCHEDULE

TAXABLE YEAR

D-1

2014

(Also Involuntary Conversions and Recapture Amounts Under IRC Sections 179

and 280F(b)(2) and R&TC Sections 17267.2, 17267.6, 17268, 24356.6, 24356.7, and 24356.8)

Complete and attach this schedule to your tax return only if your California gains or losses are different from your federal gains or losses.

Name(s) as shown on tax return

SSN, ITIN, CA SOS file no., California Corp. no., or FEIN

Part I

Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other

Than Casualty and Theft – Property Held More Than 1 Year

Use federal Form 4684, Casualties and Thefts, to report involuntary conversions from casualty and theft.

1 Enter the gross proceeds from sales or exchanges reported to you for 2014 on federal Form(s) 1099-S,

Proceeds From Real Estate Transactions (or a substitute statement), that you will be including on line 2 or

line 10, (column (d)), or on line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Description of

Date acquired

Date sold

Gross sales

Depreciation

Cost or other

Gain or (Loss)

property

(mm/dd/yyyy)

(mm/dd/yyyy)

price

allowed or

basis, plus

Subtract (f) from

allowable since

improvements and

the sum of (d)

acquisition

expense of sale

and (e)

3 Gain, if any, from federal Form 4684, line 39 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 IRC Section 1231 gain from installment sales from form FTB 3805E, line 26 or line 37 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 IRC Section 1231 gain or (loss) from like-kind exchanges from federal Form 8824 (completed using California amounts) . . . .

5

6 Gain, if any, from line 35, from other than casualty and theft . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Combine line 2 through line 6 . Enter gain or (loss) here and on the appropriate line as follows: . . . . . . . . . . . . . . . . . . . . . . . . .

7

IRC Section 179 Assets: For reporting the sale or disposition of assets for which an IRC Section 179 expense deduction was

claimed in a prior year, see instructions . Partnerships or Limited Liability Companies (classified as partnerships): Enter the gain

or (loss) on Schedule K (565 or 568), line 10 . Skip lines 8, 9, 11, and 12 below . S corporations: If line 7 is zero or a loss, enter the

amount on line 11 below and skip line 8 and line 9 . If line 7 is a gain, continue to line 8 . All others: If line 7 is zero or a loss, enter

the amount on line 11 below and skip line 8 and line 9 . If line 7 is a gain and you did not have any prior year IRC Section 1231 losses,

or they were recaptured in an earlier year, enter the gain as follows: Form 540 and Long Form 540NR filers, enter the gain on

Schedule D (540 or 540NR), line 1, and skip lines 8, 9, and 12 below; Form 100 and Form 100W filers, enter the gain on

Schedule D, Side 6, Part II, line 6, and skip lines 8, 9, and 12 below .

8 Nonrecaptured net IRC Section 1231 losses from prior years . Enter as a positive number . See instructions . . . . . . . . . . . . . . .

8

9 Subtract line 8 from line 7 . If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

S corporations: If line 9 is more than zero, enter this amount on Schedule D (100S), Side 2, Section B, Part II, line 5 and enter the

amount, if any, from line 8 on line 12 below . If line 9 is zero, enter the amount from line 7 on line 12 below . All others: If line 9

is more than zero, enter the amount from line 8 on line 12 below, and enter the amount from line 9 as follows: Form 540 and

Long Form 540NR filers, enter as a capital gain on Schedule D (540 or 540NR), line 1; Form 100 and Form 100W filers, enter

the gain on Schedule D, Side 6, Part II, line 6 . If line 9 is zero, enter the amount from line 7 on line 12 below . See instructions .

Part II Section A – Ordinary Gains and Losses

10 Ordinary gains and losses not included on line 11 through line 16 (include property held 1 year or less):

11 (

)

11 Loss, if any, from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Gain, if any, from line 7, or amount from line 8, if applicable . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Gain, if any, from line 34 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Net gain or (loss) from federal Form 4684, line 31 and line 38a (completed using California amounts) . . . . . . . . . . . . . . . . . . .

14

15 Ordinary gain from installment sales from form FTB 3805E, line 25 or line 36 . See instructions . . . . . . . . . . . . . . . . . . . . . . . . .

15

16 Ordinary gain or (loss) from like-kind exchanges from federal Form 8824 (completed using California amounts) . . . . . . . . . . .

16

17 Combine line 10 through line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18 For all except individual tax returns, enter the amount from line 17 on the appropriate line of your tax return and skip line a

and line b below . For individual tax returns, complete line a and line b below: see instructions .

a If the loss on line 11 includes a loss from federal Form 4684, Section B, Part II, column (b)(ii), enter that part of the

loss here . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18a

b Redetermine the gain or (loss) on line 17, excluding the loss, if any, on line 18a . Enter here and on line 20 . . . . . . . . . . . . .

18b

Schedule D-1 2014 Side 1

7811143

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2