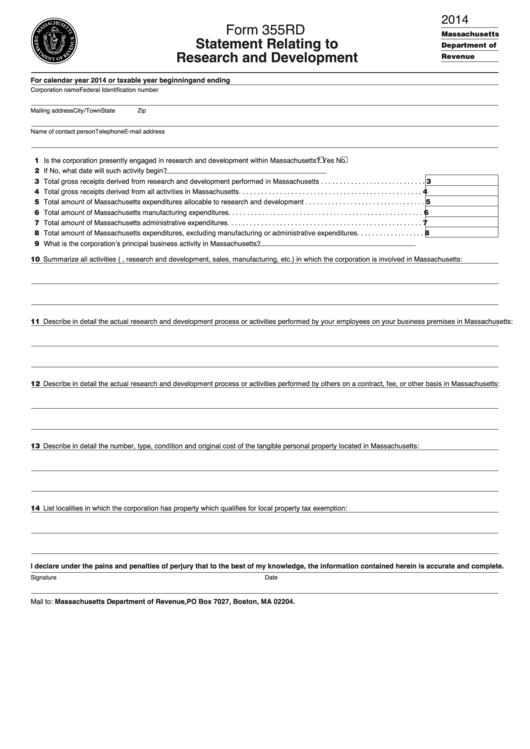

Form 355rd - Massachusetts Statement Relating To Research And Development

ADVERTISEMENT

2014

Form 355RD

Statement Relating to

Research and Development

Massachusetts

Department of

Revenue

For calendar year 2014 or taxable year beginning

and ending

Corporation name

Federal Identification number

Mailing address

City/Town

State

Zip

Name of contact person

Telephone

E-mail address

1 Is the corporation presently engaged in research and development within Massachusetts?

Yes

No

2 If No, what date will such activity begin?

3 Total gross receipts derived from research and development performed in Massachusetts . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total gross receipts derived from all activities in Massachusetts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Total amount of Massachusetts expenditures allocable to research and development . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Total amount of Massachusetts manufacturing expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Total amount of Massachusetts administrative expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Total amount of Massachusetts expenditures, excluding manufacturing or administrative expenditures . . . . . . . . . . . . . . . . . . 8

9 What is the corporation’s principal business activity in Massachusetts?

10 Summarize all activities (e.g., research and development, sales, manufacturing, etc.) in which the corporation is involved in Massachusetts:

11 Describe in detail the actual research and development process or activities performed by your employees on your business premises in Massachusetts:

12 Describe in detail the actual research and development process or activities performed by others on a contract, fee, or other basis in Massachusetts:

13 Describe in detail the number, type, condition and original cost of the tangible personal property located in Massachusetts:

14 List localities in which the corporation has property which qualifies for local property tax exemption:

I declare under the pains and penalties of perjury that to the best of my knowledge, the information contained herein is accurate and complete.

Signature

Date

Mail to: Massachusetts Department of Revenue, PO Box 7027, Boston, MA 02204.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2