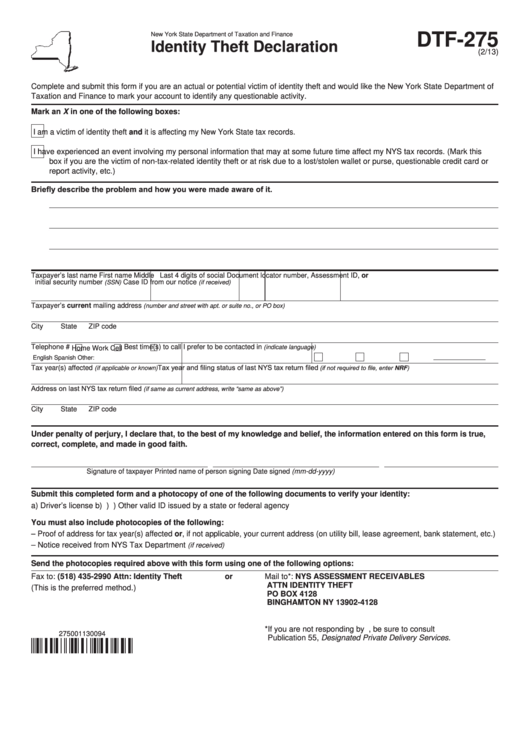

New York State Department of Taxation and Finance

DTF-275

Identity Theft Declaration

(2/13)

Complete and submit this form if you are an actual or potential victim of identity theft and would like the New York State Department of

Taxation and Finance to mark your account to identify any questionable activity.

Mark an X in one of the following boxes:

I am a victim of identity theft and it is affecting my New York State tax records.

I have experienced an event involving my personal information that may at some future time affect my NYS tax records. (Mark this

box if you are the victim of non-tax-related identity theft or at risk due to a lost/stolen wallet or purse, questionable credit card or

report activity, etc.)

Briefly describe the problem and how you were made aware of it.

Taxpayer’s last name

First name

Middle Last 4 digits of social

Document locator number, Assessment ID, or

initial

security number

Case ID from our notice

(SSN)

(if received)

Taxpayer’s current mailing address

(number and street with apt. or suite no., or PO box)

City

State

ZIP code

Telephone #

Best time(s) to call

I prefer to be contacted in

(indicate language)

Home

Work

Cell

English

Spanish

Other:

Tax year and filing status of last NYS tax return filed

(if not required to file, enter NRF)

Tax year(s) affected

(if applicable or known)

Address on last NYS tax return filed

(if same as current address, write “same as above”)

City

State

ZIP code

Under penalty of perjury, I declare that, to the best of my knowledge and belief, the information entered on this form is true,

correct, complete, and made in good faith.

Signature of taxpayer

Printed name of person signing

Date signed (mm-dd-yyyy)

Submit this completed form and a photocopy of one of the following documents to verify your identity:

a) Driver’s license

b) U.S. passport

c) U.S. military ID card

d) Other valid ID issued by a state or federal agency

You must also include photocopies of the following:

– Proof of address for tax year(s) affected or, if not applicable, your current address (on utility bill, lease agreement, bank statement, etc.)

– Notice received from NYS Tax Department

(if received)

Send the photocopies required above with this form using one of the following options:

Fax to: (518) 435-2990 attn: Identity Theft

or

Mail to*: NYS aSSeSSMeNT receIvableS

aTTN IDeNTITY THeFT

(This is the preferred method.)

PO bOx 4128

bINgHaMTON NY 13902-4128

*If you are not responding by U.S. Mail, be sure to consult

275001130094

Publication 55, Designated Private Delivery Services.

1

1