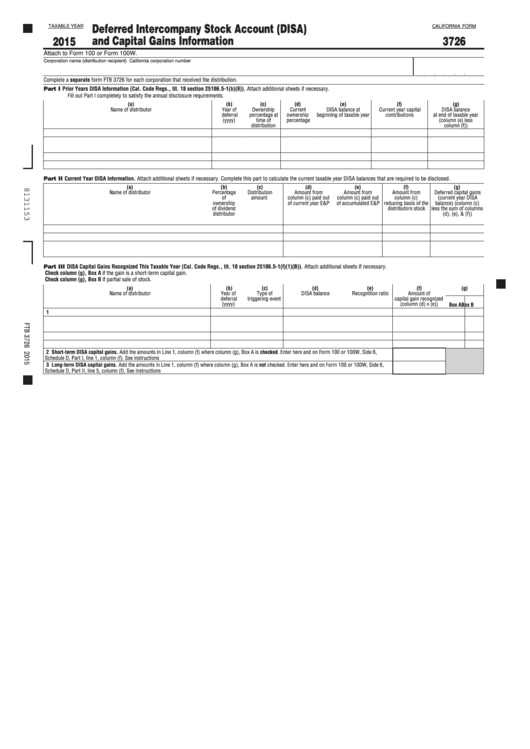

Deferred Intercompany Stock Account (DISA)

TAXABLE YEAR

CALIFORNIA FORM

and Capital Gains Information

2015

3726

Attach to Form 100 or Form 100W.

Corporation name (distribution recipient)

California corporation number

Complete a separate form FTB 3726 for each corporation that received the distribution.

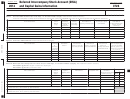

Part I

Prior Years DISA Information (Cal. Code Regs., tit. 18 section 25106.5-1(b)(8)). Attach additional sheets if necessary.

Fill out Part l completely to satisfy the annual disclosure requirements.

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Name of distributor

Year of

Ownership

Current

DISA balance at

Current year capital

DISA balance

deferral

percentage at

ownership

beginning of taxable year

contributions

at end of taxable year

(yyyy)

time of

percentage

(column (e) less

distribution

column (f))

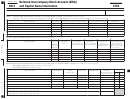

Part II Current Year DISA Information. Attach additional sheets if necessary. Complete this part to calculate the current taxable year DISA balances that are required to be disclosed.

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Name of distributor

Percentage

Distribution

Amount from

Amount from

Amount from

Deferred capital gains

of

amount

column (c) paid out

column (c) paid out

column (c)

(current year DISA

ownership

of current year E&P

of accumulated E&P

reducing basis of the

balance) (column (c)

of dividend

distributors stock

less the sum of columns

distributor

(d), (e), & (f))

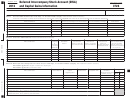

Part III DISA Capital Gains Recognized This Taxable Year (Cal. Code Regs., tit. 18 section 25106.5-1(f)(1)(B)). Attach additional sheets if necessary.

Check column (g), Box A if the gain is a short-term capital gain.

Check column (g), Box B if partial sale of stock.

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Name of distributor

Year of

Type of

DISA balance

Recognition ratio

Amount of

deferral

triggering event

capital gain recognized

(yyyy)

(column (d) x (e))

Box A

Box B

1

2 Short-term DISA capital gains. Add the amounts in Line 1, column (f) where column (g), Box A is checked. Enter here and on Form 100 or 100W, Side 6,

Schedule D, Part I, line 1, column (f). See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Long-term DISA capital gains. Add the amounts in Line 1, column (f) where column (g), Box A is not checked. Enter here and on Form 100 or 100W, Side 6,

Schedule D, Part II, line 5, column (f). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

1