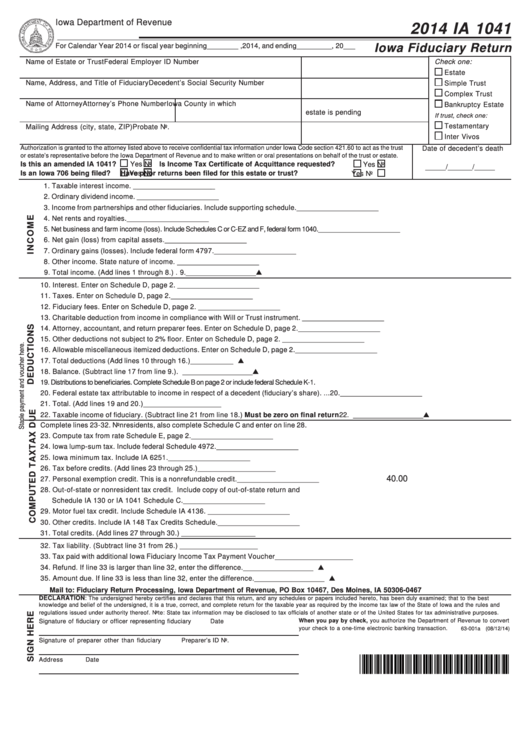

Iowa Department of Revenue

2014 IA 1041

For Calendar Year 2014 or fiscal year beginning ________ ,2014, and ending _________ , 20 ___

Iowa Fiduciary Return

Name of Estate or Trust

Federal Employer ID Number

Check one:

Estate

Name, Address, and Title of Fiduciary

Decedent’s Social Security Number

Simple Trust

Complex Trust

Name of Attorney

Attorney’s Phone Number

Iowa County in which

Bankruptcy Estate

estate is pending

If trust, check one:

Testamentary

Mailing Address (city, state, ZIP)

Probate No.

Inter Vivos

Authorization is granted to the attorney listed above to receive confidential tax information under Iowa Code section 421.60 to act as the trust

Date of decedent’s death

or estate’s representative before the Iowa Department of Revenue and to make written or oral presentations on behalf of the trust or estate.

Is this an amended IA 1041?

Yes

No

Is Income Tax Certificate of Acquittance requested?

Yes

No

_____/______/_____

Is an Iowa 706 being filed?

Yes

No

Have prior returns been filed for this estate or trust?

Yes

No

1. Taxable interest income. ......................................................................................................... 1. _____________________

2. Ordinary dividend income. ....................................................................................................... 2. _____________________

3. Income from partnerships and other fiduciaries. Include supporting schedule. ................... 3. _____________________

4. Net rents and royalties. ........................................................................................................... 4. _____________________

5. Net business and farm income (loss). Include Schedules C or C-EZ and F, federal form 1040. ....... 5. _____________________

6. Net gain (loss) from capital assets. ........................................................................................ 6. _____________________

7. Ordinary gains (losses). Include federal form 4797. .............................................................. 7. _____________________

8. Other income. State nature of income. .................................................................................. 8. _____________________

9. Total income. (Add lines 1 through 8.) ................................................................................................................................ 9. __________________

10. Interest. Enter on Schedule D, page 2. ................................................................................ 10. _____________________

11. Taxes. Enter on Schedule D, page 2. .................................................................................. 11. _____________________

12. Fiduciary fees. Enter on Schedule D, page 2. ..................................................................... 12. _____________________

13. Charitable deduction from income in compliance with Will or Trust instrument. ............... 13. _____________________

14. Attorney, accountant, and return preparer fees. Enter on Schedule D, page 2. ................ 14. _____________________

15. Other deductions not subject to 2% floor. Enter on Schedule D, page 2. ......................... 15. _____________________

16. Allowable miscellaneous itemized deductions. Enter on Schedule D, page 2. ................. 16. _____________________

17. Total deductions (Add lines 10 through 16.) ..................................................................................................................... 17. __________________

18. Balance. (Subtract line 17 from line 9.) ............................................................................................................................. 18. __________________

19. Distributions to beneficiaries. Complete Schedule B on page 2 or include federal Schedule K-1. ...... 19. _____________________

20. Federal estate tax attributable to income in respect of a decedent (fiduciary’s share). ... 20. _____________________

21. Total. (Add lines 19 and 20.) .............................................................................................................................................. 21. ____________________

22. Taxable income of fiduciary. (Subtract line 21 from line 18.) Must be zero on final return ........................................ 22. __________________

Complete lines 23-32. Nonresidents, also complete Schedule C and enter on line 28.

23. Compute tax from rate Schedule E, page 2. ........................................................................ 23. _____________________

24. Iowa lump-sum tax. Include federal Schedule 4972. ........................................................... 24. _____________________

25. Iowa minimum tax. Include IA 6251. .................................................................................... 25. _____________________

26. Tax before credits. (Add lines 23 through 25.) ................................................................................................................. 26. ____________________

40.00

27. Personal exemption credit. This is a nonrefundable credit. ................................................ 27. _____________________

28. Out-of-state or nonresident tax credit. Include copy of out-of-state return and

Schedule IA 130 or IA 1041 Schedule C. ............................................................................ 28. _____________________

29. Motor fuel tax credit. Include Schedule IA 4136. ................................................................ 29. _____________________

30. Other credits. Include IA 148 Tax Credits Schedule. .......................................................... 30. _____________________

31. Total credits. (Add lines 27 through 30.) ........................................................................................................................... 31. ____________________

32. Tax liability. (Subtract line 31 from 26.) ............................................................................................................................ 32. ____________________

33. Tax paid with additional Iowa Fiduciary Income Tax Payment Voucher ......................................................................... 33. ____________________

34. Refund. If line 33 is larger than line 32, enter the difference. ......................................................................................... 34. __________________

35. Amount due. If line 33 is less than line 32, enter the difference. .................................................................................... 35. __________________

Mail to: Fiduciary Return Processing, Iowa Department of Revenue, PO Box 10467, Des Moines, IA 50306-0467

DECLARATION:

The undersigned hereby certifies and declares that this return, and any schedules or papers included hereto, has been duly examined; that to the best

knowledge and belief of the undersigned, it is a true, correct, and complete return for the taxable year as required by the income tax law of the State of Iowa and the rules and

regulations issued under authority thereof. Note: State tax information may be disclosed to tax officials of another state or of the United States for tax administrative purposes.

When you pay by check, you authorize the Department of Revenue to convert

Signature of fiduciary or officer representing fiduciary

Date

your check to a one-time electronic banking transaction.

63-001a

(08/12/14)

Signature of preparer other than fiduciary

Preparer’s ID No.

*1463001019999*

Address

Date

1

1 2

2