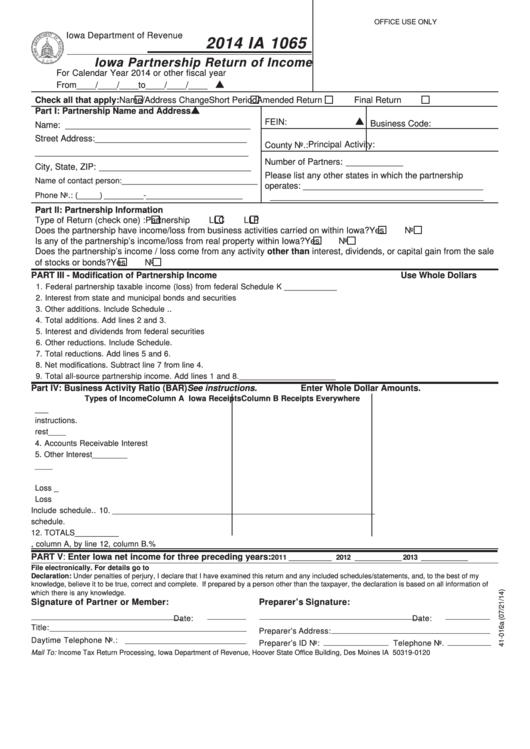

OFFICE USE ONLY

Iowa Department of Revenue

2014 IA 1065

Iowa Partnership Return of Income

For Calendar Year 2014 or other fiscal year

From____/____/____to____/____/____

Check all that apply:

Name/Address Change

Short Period

Amended Return

Final Return

Part I: Partnership Name and Address

FEIN:

Business Code:

Name: _______________________________________

Street Address: ________________________________

Principal Activity:

County No.:

_____________________________________________

Number of Partners: ____________

City, State, ZIP: ________________________________

Please list any other states in which the partnership

Name of contact person: _______________________________

operates: ______________________________________

Phone No.: ( _____ ) _________ - ______________________

_____________________________________________

Part II: Partnership Information

Type of Return (check one) :

Partnership

LLC

LLP

Does the partnership have income/loss from business activities carried on within Iowa?

Yes

No

Is any of the partnership’s income/loss from real property within Iowa?

Yes

No

Does the partnership’s income / loss come from any activity other than interest, dividends, or capital gain from the sale

of stocks or bonds?

Yes

No

PART III - Modification of Partnership Income

Use Whole Dollars

1. Federal partnership taxable income (loss) from federal Schedule K ............................................ 1. _______________________

2. Interest from state and municipal bonds and securities ................... 2. ______________________

3. Other additions. Include Schedule .. ................................................. 3. ______________________

4. Total additions. Add lines 2 and 3. .................................................................................................. 4. _______________________

5. Interest and dividends from federal securities .................................. 5. ______________________

6. Other reductions. Include Schedule. ................................................. 6. ______________________

7. Total reductions. Add lines 5 and 6. ................................................................................................ 7. _______________________

8. Net modifications. Subtract line 7 from line 4. ................................................................................. 8. _______________________

9. Total all-source partnership income. Add lines 1 and 8. ................................................................ 9. _______________________

Part IV: Business Activity Ratio (BAR) See instructions.

Enter Whole Dollar Amounts.

Types of Income

Column A Iowa Receipts

Column B Receipts Everywhere

1. Gross Receipts .................................................... 1. ____________________________________________________________

2. Net Dividends. See instructions. ......................... 2. ____________________________________________________________

3. Exempt Interest .................................................... 3. ____________________________________________________________

4. Accounts Receivable Interest .............................. 4. ____________________________________________________________

5. Other Interest ........................................................ 5. ____________________________________________________________

6. Rent ..................................................................... 6. ____________________________________________________________

7. Royalties .............................................................. 7. ____________________________________________________________

8. Capital Gains / Loss ............................................ 8. ____________________________________________________________

9. Ordinary Gains / Loss .......................................... 9. ____________________________________________________________

10. Partnership Gross Receipts. Include schedule.. 10. ____________________________________________________________

11. Other. Must include schedule. ............................ 11. ____________________________________________________________

12. TOTALS ................................................................ 12. ____________________________________________________________

13. BAR to six decimal places. Divide line 12, column A, by line 12, column B.

%

PART V: Enter Iowa net income for three preceding years:

2011 ___________ 2012 ____________ 2013 ____________

File electronically. For details go to .

Declaration: Under penalties of perjury, I declare that I have examined this return and any included schedules/statements, and, to the best of my

knowledge, believe it to be true, correct and complete. If prepared by a person other than the taxpayer, the declaration is based on all information of

which there is any knowledge.

Signature of Partner or Member:

Preparer’s Signature:

Date:

Date:

Title:

Preparer’s Address:

Daytime Telephone No.:

Preparer’s ID No:

Telephone No.

Mail To: Income Tax Return Processing, Iowa Department of Revenue, Hoover State Office Building, Des Moines IA 50319-0120

1

1 2

2