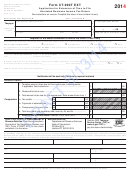

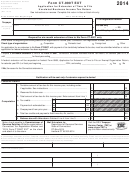

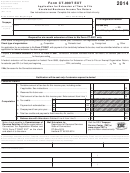

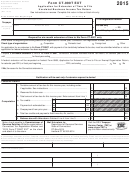

Form Ct-1065/ct-1120si Ext - Application For Extension Of Time To File Connecticut Composite Income Tax Return - 2014

ADVERTISEMENT

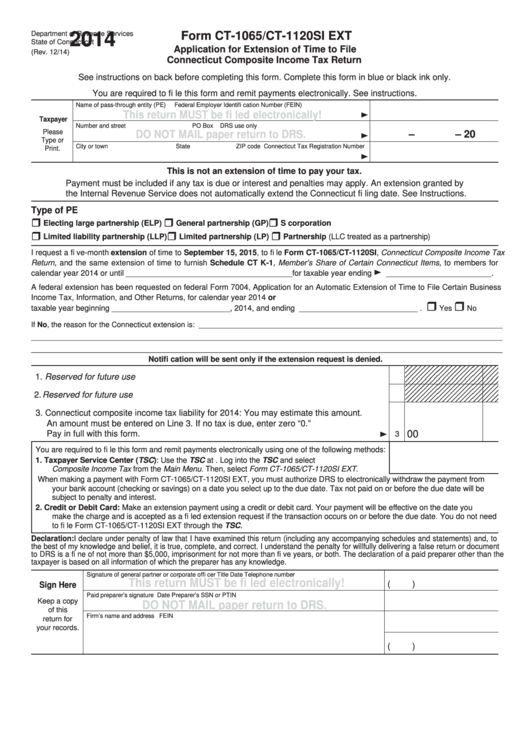

Department of Revenue Services

Form CT-1065/CT-1120SI EXT

2014

State of Connecticut

Application for Extension of Time to File

(Rev. 12/14)

Connecticut Composite Income Tax Return

See instructions on back before completing this form. Complete this form in blue or black ink only.

You are required to fi le this form and remit payments electronically. See instructions.

Name of pass-through entity (PE)

Federal Employer Identifi cation Number (FEIN)

This return MUST be fi led electronically!

Taxpayer

Number and street

PO Box

DRS use only

Please

DO NOT MAIL paper return to DRS.

–

– 20

Type or

City or town

State

ZIP code

Connecticut Tax Registration Number

Print.

This is not an extension of time to pay your tax.

Payment must be included if any tax is due or interest and penalties may apply. An extension granted by

the Internal Revenue Service does not automatically extend the Connecticut fi ling date. See Instructions.

Type of PE

Electing large partnership (ELP)

General partnership (GP)

S corporation

Limited liability partnership (LLP)

Limited partnership (LP)

Partnership (LLC treated as a partnership)

I request a fi ve-month extension of time to September 15, 2015, to fi le Form CT-1065/CT-1120SI, Connecticut Composite Income Tax

Return, and the same extension of time to furnish Schedule CT K-1, Member’s Share of Certain Connecticut Items, to members for

calendar year 2014 or until ______________________________________ for taxable year ending

________________________ .

A federal extension has been requested on federal Form 7004, Application for an Automatic Extension of Time to File Certain Business

Income Tax, Information, and Other Returns, for calendar year 2014 or

taxable year beginning ___________________________ , 2014, and ending ___________________________ .

Yes

No

If No, the reason for the Connecticut extension is:

______________________________________________________________________________

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

Notifi cation will be sent only if the extension request is denied.

1. Reserved for future use ....................................................................................................... 1

2. Reserved for future use ....................................................................................................... 2

3. Connecticut composite income tax liability for 2014: You may estimate this amount.

An amount must be entered on Line 3. If no tax is due, enter zero “0.”

00

Pay in full with this form. ..................................................................................................

3

You are required to fi le this form and remit payments electronically using one of the following methods:

1.

Taxpayer Service Center (TSC): Use the TSC at Log into the TSC and select

Composite Income Tax from the Main Menu. Then, select Form CT-1065/CT-1120SI EXT.

When making a payment with Form CT-1065/CT-1120SI EXT, you must authorize DRS to electronically withdraw the payment from

your bank account (checking or savings) on a date you select up to the due date. Tax not paid on or before the due date will be

subject to penalty and interest.

2.

Credit or Debit Card: Make an extension payment using a credit or debit card. Your payment will be effective on the date you

make the charge and is accepted as a fi led extension request if the transaction occurs on or before the due date. You do not need

to fi le Form CT-1065/CT-1120SI EXT through the TSC.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to

the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document

to DRS is a fi ne of not more than $5,000, imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other than the

taxpayer is based on all information of which the preparer has any knowledge.

Signature of general partner or corporate offi cer

Title

Date

Telephone number

This return MUST be fi led electronically!

(

)

Sign Here

Paid preparer’s signature

Date

Preparer’s SSN or PTIN

Keep a copy

DO NOT MAIL paper return to DRS.

of this

Firm’s name and address

FEIN

return for

your records.

Telephone number

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2