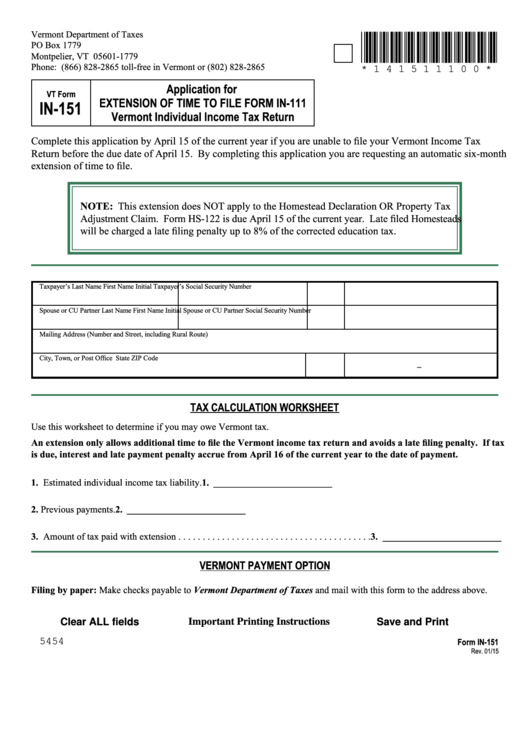

Vermont Department of Taxes

*141511100*

PO Box 1779

Montpelier, VT 05601-1779

Phone: (866) 828-2865 toll-free in Vermont or (802) 828-2865

* 1 4 1 5 1 1 1 0 0 *

Application for

VT Form

EXTENSION OF TIME TO FILE FORM IN-111

IN-151

Vermont Individual Income Tax Return

Complete this application by April 15 of the current year if you are unable to file your Vermont Income Tax

Return before the due date of April 15. By completing this application you are requesting an automatic six-month

extension of time to file.

NOTE: This extension does NOT apply to the Homestead Declaration OR Property Tax

Adjustment Claim. Form HS-122 is due April 15 of the current year. Late filed Homesteads

will be charged a late filing penalty up to 8% of the corrected education tax.

Taxpayer’s Last Name

First Name

Initial

Taxpayer’s Social Security Number

Spouse or CU Partner Last Name

First Name

Initial

Spouse or CU Partner Social Security Number

Mailing Address (Number and Street, including Rural Route)

City, Town, or Post Office

State

ZIP Code

-

TAX CALCULATION WORKSHEET

Use this worksheet to determine if you may owe Vermont tax.

An extension only allows additional time to file the Vermont income tax return and avoids a late filing penalty. If tax

is due, interest and late payment penalty accrue from April 16 of the current year to the date of payment.

1. Estimated individual income tax liability. . . . . . . . .1. _________________________

2. Previous payments. . . . . . . . . . . . . . . . . . . . . . . . . .2. _________________________

3. Amount of tax paid with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. _________________________

VERMONT PAYMENT OPTION

Filing by paper: Make checks payable to Vermont Department of Taxes and mail with this form to the address above.

Clear ALL fields

Important Printing Instructions

Save and Print

5454

Form IN-151

Rev. 01/15

1

1