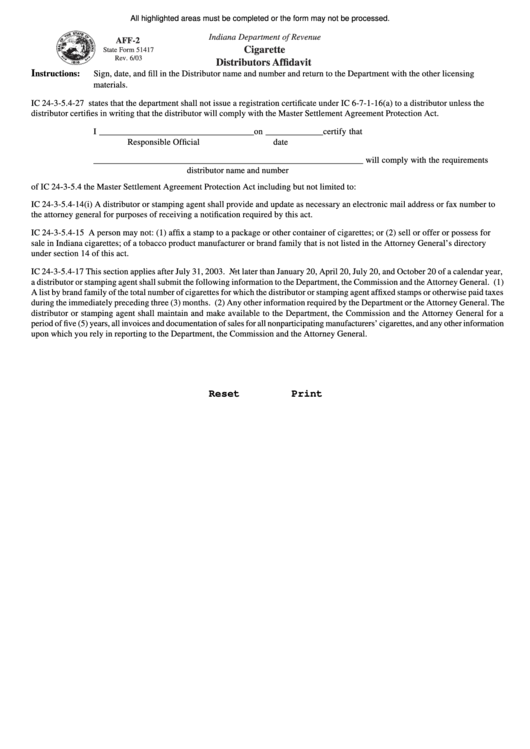

All highlighted areas must be completed or the form may not be processed.

Indiana Department of Revenue

AFF-2

Cigarette

State Form 51417

Rev. 6/03

Distributors Affidavit

I

nstructions:

Sign, date, and fill in the Distributor name and number and return to the Department with the other licensing

materials.

IC 24-3-5.4-27 states that the department shall not issue a registration certificate under IC 6-7-1-16(a) to a distributor unless the

distributor certifies in writing that the distributor will comply with the Master Settlement Agreement Protection Act.

I ___________________________________on _____________certify that

Responsible Official

date

_____________________________________________________________ will comply with the requirements

distributor name and number

of IC 24-3-5.4 the Master Settlement Agreement Protection Act including but not limited to:

IC 24-3-5.4-14(i) A distributor or stamping agent shall provide and update as necessary an electronic mail address or fax number to

the attorney general for purposes of receiving a notification required by this act.

IC 24-3-5.4-15 A person may not: (1) affix a stamp to a package or other container of cigarettes; or (2) sell or offer or possess for

sale in Indiana cigarettes; of a tobacco product manufacturer or brand family that is not listed in the Attorney General’s directory

under section 14 of this act.

IC 24-3-5.4-17 This section applies after July 31, 2003. Not later than January 20, April 20, July 20, and October 20 of a calendar year,

a distributor or stamping agent shall submit the following information to the Department, the Commission and the Attorney General. (1)

A list by brand family of the total number of cigarettes for which the distributor or stamping agent affixed stamps or otherwise paid taxes

during the immediately preceding three (3) months. (2) Any other information required by the Department or the Attorney General. The

distributor or stamping agent shall maintain and make available to the Department, the Commission and the Attorney General for a

period of five (5) years, all invoices and documentation of sales for all nonparticipating manufacturers’ cigarettes, and any other information

upon which you rely in reporting to the Department, the Commission and the Attorney General.

Reset

Print

1

1