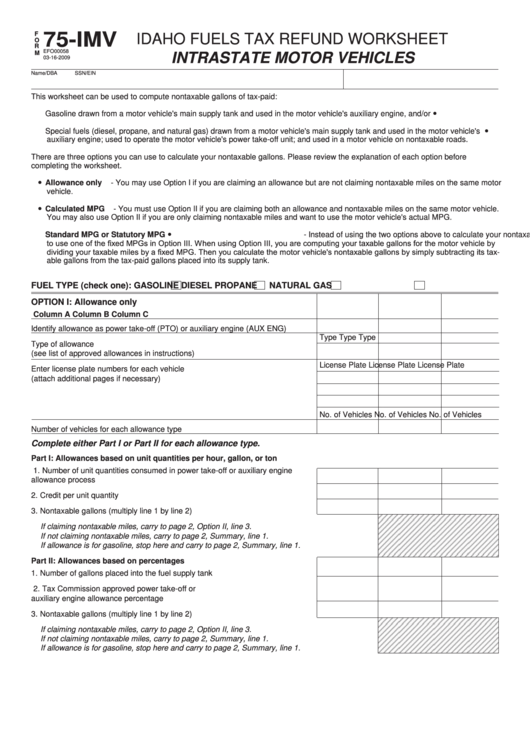

Form 75-Imv - Idaho Fuels Tax Refund Worksheet - Intrastate Motor Vehicles

ADVERTISEMENT

F

75-IMV

idaho fuels tax refund WorKsheet

O

R

efo00058

M

intrastate motor vehicles

03-16-2009

name/dBa

ssn/ein

this worksheet can be used to compute nontaxable gallons of tax-paid:

y

Gasoline drawn from a motor vehicle's main supply tank and used in the motor vehicle's auxiliary engine, and/or

y

special fuels (diesel, propane, and natural gas) drawn from a motor vehicle's main supply tank and used in the motor vehicle's

auxiliary engine; used to operate the motor vehicle's power take-off unit; and used in a motor vehicle on nontaxable roads.

there are three options you can use to calculate your nontaxable gallons. Please review the explanation of each option before

completing the worksheet.

y

Allowance only

- You may use option i if you are claiming an allowance but are not claiming nontaxable miles on the same motor

vehicle.

y

Calculated MPG

- You must use option ii if you are claiming both an allowance and nontaxable miles on the same motor vehicle.

You may also use option ii if you are only claiming nontaxable miles and want to use the motor vehicle's actual MPG.

y

Standard MPG or Statutory MPG

- instead of using the two options above to calculate your nontaxable gallons, you may be able

to use one of the fixed MPGs in Option III. When using Option III, you are computing your taxable gallons for the motor vehicle by

dividing your taxable miles by a fixed MPG. Then you calculate the motor vehicle's nontaxable gallons by simply subtracting its tax-

able gallons from the tax-paid gallons placed into its supply tank.

FUEL TYPE (check one):

GASOLInE

DIESEL

PROPAnE

nATURAL GAS

OPTIOn I:

Allowance only

Column A

Column B

Column C

identify allowance as power take-off (Pto) or auxiliary engine (aux enG) ...........

type

type

type

type of allowance

(see list of approved allowances in instructions) .....................................................

license Plate

license Plate

license Plate

enter license plate numbers for each vehicle

(attach additional pages if necessary) .....................................................................

no. of Vehicles

no. of Vehicles no. of Vehicles

number of vehicles for each allowance type ...........................................................

complete either Part i or Part ii for each allowance type.

Part I:

Allowances based on unit quantities per hour, gallon, or ton

1.

number of unit quantities consumed in power take-off or auxiliary engine

allowance process .......................................................................................

2.

Credit per unit quantity allowed....................................................................

3.

nontaxable gallons (multiply line 1 by line 2) ...............................................

If claiming nontaxable miles, carry to page 2, Option II, line 3.

If not claiming nontaxable miles, carry to page 2, Summary, line 1.

If allowance is for gasoline, stop here and carry to page 2, Summary, line 1.

Part II: Allowances based on percentages

1.

number of gallons placed into the fuel supply tank .....................................

2.

tax Commission approved power take-off or

auxiliary engine allowance percentage ........................................................

3.

nontaxable gallons (multiply line 1 by line 2) ...............................................

If claiming nontaxable miles, carry to page 2, Option II, line 3.

If not claiming nontaxable miles, carry to page 2, Summary, line 1.

If allowance is for gasoline, stop here and carry to page 2, Summary, line 1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4