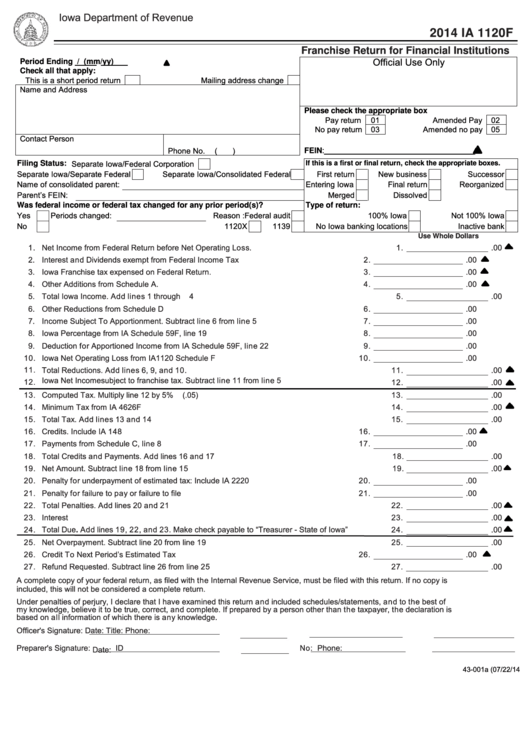

Form Ia 1120f - Franchise Return For Financial Institutions - 2014

ADVERTISEMENT

Iowa Department of Revenue

2014 IA 1120F

Franchise Return for Financial Institutions

Official Use Only

Period Ending

/

(mm/yy)

Check all that apply:

This is a short period return

Mailing address change

Name and Address

Please check the appropriate box

Pay return

01

Amended Pay

02

No pay return

03

Amended no pay

05

Contact Person

Phone No.

(

)

_______________________________________

FEIN:

Filing Status: Separate Iowa/Federal Corporation

If this is a first or final return, check the appropriate boxes.

Separate Iowa/Separate Federal

Separate Iowa/Consolidated Federal

First return

New business

Successor

Name of consolidated parent:

Entering Iowa

Final return

Reorganized

Parent’s FEIN:

Merged

Dissolved

Was federal income or federal tax changed for any prior period(s)?

Type of return:

Yes

Periods changed:

Reason :Federal audit

100% Iowa

Not 100% Iowa

No

1120X

1139

No Iowa banking locations

Inactive bank

Use Whole Dollars

1. Net Income from Federal Return before Net O perating L oss. ................................................

1.

.00

2. Interest and Dividends exempt from Federal Income Tax ...............................................

2.

.00

3. Iowa Franchise tax expensed on Federal Return. .....................................................

3.

.00

4. Other Additions from Schedule A. .....................................................................................

4.

.00

5. Total Iowa Income. Add lines 1 through 4 ...............................................................................

5.

.00

6. Other Reductions from Schedule D ....................................................................................

6.

.00

7. Income Subject To Apportionment. Subtract line 6 from line 5 ...................................

7.

.00

8. Iowa Percentage from IA Schedule 59F, line 19 ...............................................................

8.

.00

9. Deduction for Apportioned Income from IA Schedule 59F, line 22 ................................

9.

.00

10. Iowa Net Operating Loss from IA1120 Schedule F ......................................................... 10.

.00

11. Total Reductions. Add lines 6, 9, and 10. ............................................................................ 11.

.00

12. Iowa Net Income subject to franchise tax. Subtract line 11 from line 5 .................................. 12.

.00

13. Computed Tax. Multiply line 12 by 5% (.05) ............................................................................. 13.

.00

14. Minimum Tax from IA 4626F ............................................................................................... 14.

.00

15. Total Tax. Add lines 13 and 14 ............................................................................................ 15.

.00

16. Credits. Include IA 148 ........................................................................................... 16.

.00

17. Payments from Schedule C, line 8 ........................................................................... 17.

.00

18. Total Credits and Payments. Add lines 16 and 17........................................................................... 18.

.00

19. Net Amount. Subtract line 18 from line 15............................................................................ 19.

.00

20. Penalty for underpayment of estimated tax: Include IA 2220 ..................................... 20.

.00

21. Penalty for failure to pay or failure to file .................................................................. 21.

.00

22. Total Penalties. Add lines 20 and 21 .................................................................................... 22.

.00

23. Interest .............................................................................................................................. 23.

.00

24. Total Due. Add lines 19, 22, and 23. Make check payable to “Treasurer - State of Iowa” ...... 24.

.00

25. Net Overpayment. Subtract line 20 from line 19 .................................................................... 25.

.00

26. Credit To Next Period’s Estimated Tax .................................................................... 26.

.00

27. Refund Requested. Subtract line 26 from line 25 .................................................................. 27.

.00

A complete copy of your federal return, as filed with the Internal Revenue Service, must be filed with this return. If no copy is

included, this will not be considered a complete return.

Under penalties of perjury, I declare that I have examined this return and included schedules/statements, and to the best of

my knowledge, believe it to be true, correct, and complete. If prepared by a person other than the taxpayer, the declaration is

based on all information of which there is any knowledge.

Officer's Signature:

Date:

Title:

Phone:

Preparer's Signature:

ID No:

Phone:

Date:

43-001a (07/22/14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2