Annualized Income Installment Worksheet For Underpayment Of Estimated Tax

ADVERTISEMENT

Attachment

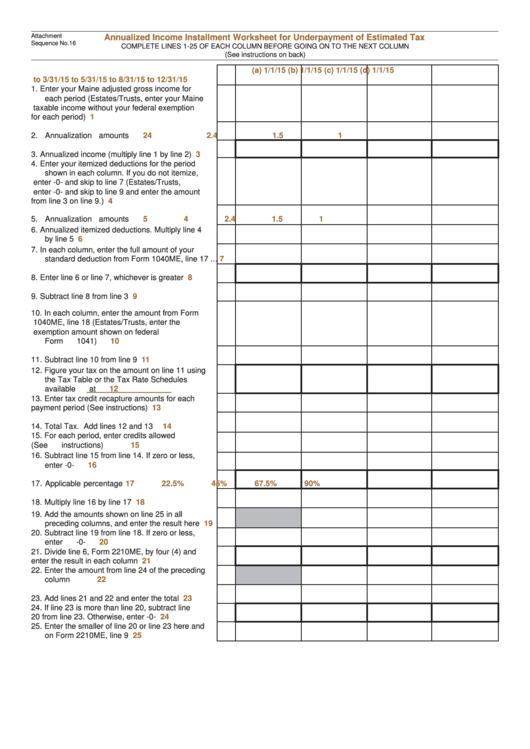

Annualized Income Installment Worksheet for Underpayment of Estimated Tax

Sequence No.16

COMPLETE LINES 1-25 OF EACH COLUMN BEFORE GOING ON TO THE NEXT COLUMN

(See instructions on back)

(a) 1/1/15

(b) 1/1/15

(c) 1/1/15

(d) 1/1/15

to 3/31/15

to 5/31/15

to 8/31/15

to 12/31/15

1. Enter your Maine adjusted gross income for

each period (Estates/Trusts, enter your Maine

taxable income without your federal exemption

for each period) .....................................................

1

2. Annualization amounts ..........................................

2

4

2.4

1.5

1

3. Annualized income (multiply line 1 by line 2) ........

3

4. Enter your itemized deductions for the period

shown in each column. If you do not itemize,

enter -0- and skip to line 7 (Estates/Trusts,

enter -0- and skip to line 9 and enter the amount

from line 3 on line 9.) .............................................

4

5. Annualization amounts ..........................................

5

4

2.4

1.5

1

6. Annualized itemized deductions. Multiply line 4

by line 5 .................................................................

6

7. In each column, enter the full amount of your

standard deduction from Form 1040ME, line 17 ...

7

8. Enter line 6 or line 7, whichever is greater ............

8

9. Subtract line 8 from line 3 .....................................

9

10. In each column, enter the amount from Form

1040ME, line 18 (Estates/Trusts, enter the

exemption amount shown on federal

Form 1041) ............................................................

10

11. Subtract line 10 from line 9 ...................................

11

12. Figure your tax on the amount on line 11 using

the Tax Table or the Tax Rate Schedules

available at

....................

12

13. Enter tax credit recapture amounts for each

payment period (See instructions) ........................

13

14. Total Tax. Add lines 12 and 13 .............................

14

15. For each period, enter credits allowed

(See instructions) ..................................................

15

16. Subtract line 15 from line 14. If zero or less,

enter -0- .................................................................

16

17. Applicable percentage ...........................................

17

22.5%

45%

67.5%

90%

18. Multiply line 16 by line 17 ......................................

18

19. Add the amounts shown on line 25 in all

preceding columns, and enter the result here .......

19

20. Subtract line 19 from line 18. If zero or less,

enter -0- .................................................................

20

21. Divide line 6, Form 2210ME, by four (4) and

enter the result in each column .............................

21

22. Enter the amount from line 24 of the preceding

column ..................................................................

22

23. Add lines 21 and 22 and enter the total ................

23

24. If line 23 is more than line 20, subtract line

20 from line 23. Otherwise, enter -0- .....................

24

25. Enter the smaller of line 20 or line 23 here and

on Form 2210ME, line 9 ........................................

25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2