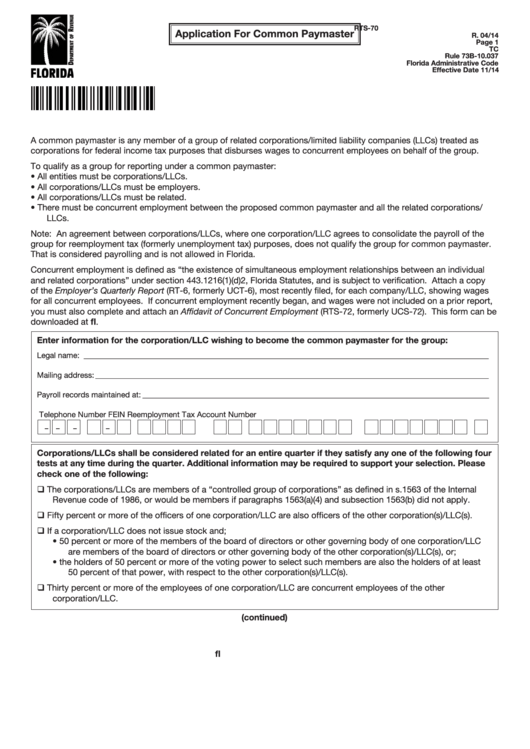

Form Rts-70 - Application For Common Paymaster

ADVERTISEMENT

RTS-70

Application For Common Paymaster

R. 04/14

Page 1

TC

Rule 73B-10.037

Florida Administrative Code

Effective Date 11/14

A common paymaster is any member of a group of related corporations/limited liability companies (LLCs) treated as

corporations for federal income tax purposes that disburses wages to concurrent employees on behalf of the group.

To qualify as a group for reporting under a common paymaster:

•

All entities must be corporations/LLCs.

•

All corporations/LLCs must be employers.

•

All corporations/LLCs must be related.

•

There must be concurrent employment between the proposed common paymaster and all the related corporations/

LLCs.

Note: An agreement between corporations/LLCs, where one corporation/LLC agrees to consolidate the payroll of the

group for reemployment tax (formerly unemployment tax) purposes, does not qualify the group for common paymaster.

That is considered payrolling and is not allowed in Florida.

Concurrent employment is defined as “the existence of simultaneous employment relationships between an individual

and related corporations” under section 443.1216(1)(d)2, Florida Statutes, and is subject to verification. Attach a copy

of the Employer’s Quarterly Report (RT-6, formerly UCT-6), most recently filed, for each company/LLC, showing wages

for all concurrent employees. If concurrent employment recently began, and wages were not included on a prior report,

you must also complete and attach an Affidavit of Concurrent Employment (RTS-72, formerly UCS-72). This form can be

downloaded at

Enter information for the corporation/LLC wishing to become the common paymaster for the group:

Legal name: ________________________________________________________________________________________________________

Mailing address: _____________________________________________________________________________________________________

Payroll records maintained at: _________________________________________________________________________________________

Telephone Number

FEIN

Reemployment Tax Account Number

–

–

–

–

Corporations/LLCs shall be considered related for an entire quarter if they satisfy any one of the following four

tests at any time during the quarter. Additional information may be required to support your selection. Please

check one of the following:

q The corporations/LLCs are members of a “controlled group of corporations” as defined in s.1563 of the Internal

Revenue code of 1986, or would be members if paragraphs 1563(a)(4) and subsection 1563(b) did not apply.

q Fifty percent or more of the officers of one corporation/LLC are also officers of the other corporation(s)/LLC(s).

q If a corporation/LLC does not issue stock and;

•

50 percent or more of the members of the board of directors or other governing body of one corporation/LLC

are members of the board of directors or other governing body of the other corporation(s)/LLC(s), or;

•

the holders of 50 percent or more of the voting power to select such members are also the holders of at least

50 percent of that power, with respect to the other corporation(s)/LLC(s).

q Thirty percent or more of the employees of one corporation/LLC are concurrent employees of the other

corporation/LLC.

(continued)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2