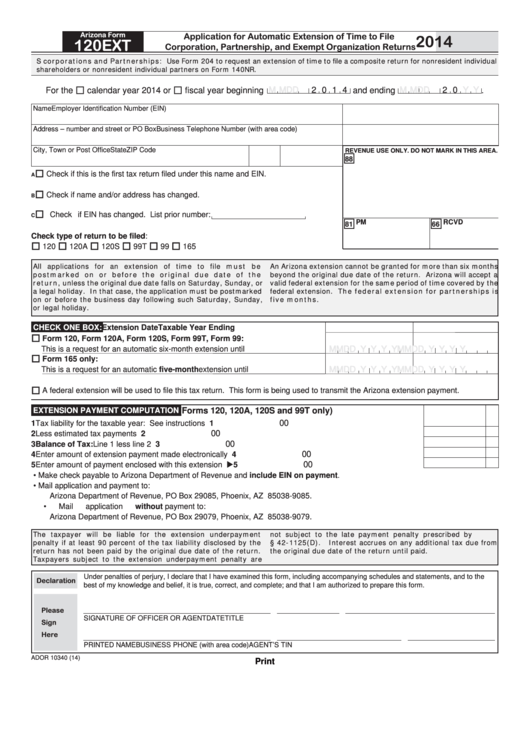

Arizona Form

Application for Automatic Extension of Time to File

2014

120EXT

Corporation, Partnership, and Exempt Organization Returns

S corporations and Partnerships: Use Form 204 to request an extension of time to file a composite return for nonresident individual

shareholders or nonresident individual partners on Form 140NR.

M M D D

2 0 1 4 and ending

M M D D

2 0

Y Y

For the

calendar year 2014 or

fiscal year beginning

.

Name

Employer Identification Number (EIN)

Address – number and street or PO Box

Business Telephone Number (with area code)

City, Town or Post Office

State

ZIP Code

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

Check if this is the first tax return filed under this name and EIN.

A

Check if name and/or address has changed.

B

Check if EIN has changed. List prior number:

C

81 PM

66 RCVD

Check type of return to be filed:

120

120A

120S

99T

99

165

All applications for an extension of time to file must be

An Arizona extension cannot be granted for more than six months

postmarked on or before the original due date of the

beyond the original due date of the return. Arizona will accept a

return, unless the original due date falls on Saturday, Sunday, or

valid federal extension for the same period of time covered by the

a legal holiday. In that case, the application must be postmarked

federal extension. The federal extension for partnerships is

on or before the business day following such Saturday, Sunday,

five months.

or legal holiday.

CHECK ONE BOX:

Extension Date

Taxable Year Ending

Form 120, Form 120A, Form 120S, Form 99T, Form 99:

This is a request for an automatic six-month extension until .................................

M M D D Y Y Y Y M M D D Y Y Y Y

Form 165 only:

M M D D Y Y Y Y M M D D Y Y Y Y

This is a request for an automatic five-month extension until ..............................

A federal extension will be used to file this tax return. This form is being used to transmit the Arizona extension payment.

(Forms 120, 120A, 120S and 99T only)

EXTENSION PAYMENT COMPUTATION

00

1 Tax liability for the taxable year: See instructions ........................................................................................... 1

00

2 Less estimated tax payments .......................................................................................................................... 2

00

3 Balance of Tax: Line 1 less line 2 .................................................................................................................. 3

00

4 Enter amount of extension payment made electronically ................................................................................ 4

5 Enter amount of payment enclosed with this extension ......................................... PAYMENT ENCLOSED 5

00

• Make check payable to Arizona Department of Revenue and include EIN on payment.

• Mail application and payment to:

Arizona Department of Revenue, PO Box 29085, Phoenix, AZ 85038-9085.

• Mail application without payment to:

Arizona Department of Revenue, PO Box 29079, Phoenix, AZ 85038-9079.

The taxpayer will be liable for the extension underpayment

not subject to the late payment penalty prescribed by A.R.S.

penalty if at least 90 percent of the tax liability disclosed by the

§ 42-1125(D).

Interest accrues on any additional tax due from

return has not been paid by the original due date of the return.

the original due date of the return until paid.

Taxpayers subject to the extension underpayment penalty are

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the

Declaration

best of my knowledge and belief, it is true, correct, and complete; and that I am authorized to prepare this form.

Please

SIGNATURE OF OFFICER OR AGENT

DATE

TITLE

Sign

Here

PRINTED NAME

BUSINESS PHONE (with area code)

AGENT’S TIN

ADOR 10340 (14)

Print

1

1