Click Here to Print Document

CLICK HERE TO CLEAR FORM

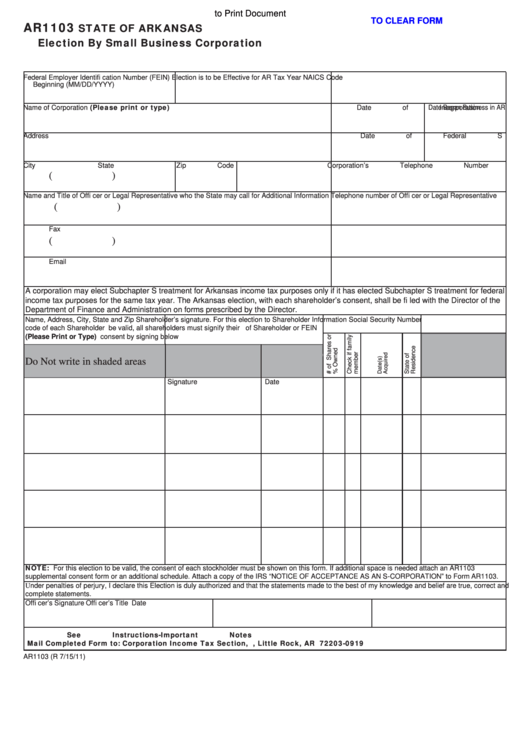

AR1103

STATE OF ARKANSAS

Election By Small Business Corporation

Federal Employer Identifi cation Number (FEIN)

Election is to be Effective for AR Tax Year

NAICS Code

Beginning (MM/DD/YYYY)

Name of Corporation (Please print or type)

Date of Incorporation

Date Began Business in AR

Address

Date of Federal S Election

State of Incorporation

City

State

Zip Code

Corporation’s Telephone Number

(

)

Name and Title of Offi cer or Legal Representative who the State may call for Additional Information

Telephone number of Offi cer or Legal Representative

(

)

Fax

(

)

Email

A corporation may elect Subchapter S treatment for Arkansas income tax purposes only if it has elected Subchapter S treatment for federal

income tax purposes for the same tax year. The Arkansas election, with each shareholder’s consent, shall be fi led with the Director of the

Department of Finance and Administration on forms prescribed by the Director.

Name, Address, City, State and Zip

Shareholder’s signature. For this election to

Shareholder Information

Social Security Number

code of each Shareholder

be valid, all shareholders must signify their

of Shareholder or FEIN

(Please Print or Type)

consent by signing below

Do Not write in shaded areas

Signature

Date

NOTE: For this election to be valid, the consent of each stockholder must be shown on this form. If additional space is needed attach an AR1103

supplemental consent form or an additional schedule. Attach a copy of the IRS “NOTICE OF ACCEPTANCE AS AN S-CORPORATION” to Form AR1103.

Under penalties of perjury, I declare this Election is duly authorized and that the statements made to the best of my knowledge and belief are true, correct and

complete statements.

Offi cer’s Signature

Offi cer’s Title

Date

See Instructions-Important Notes

Mail Completed Form to: Corporation Income Tax Section, P.O.Box 919, Little Rock, AR 72203-0919

AR1103 (R 7/15/11)

1

1