Form 3805p - California Additional Taxes On Qualified Plans (Including Iras) And Other Tax-Favored Accounts - 2014

ADVERTISEMENT

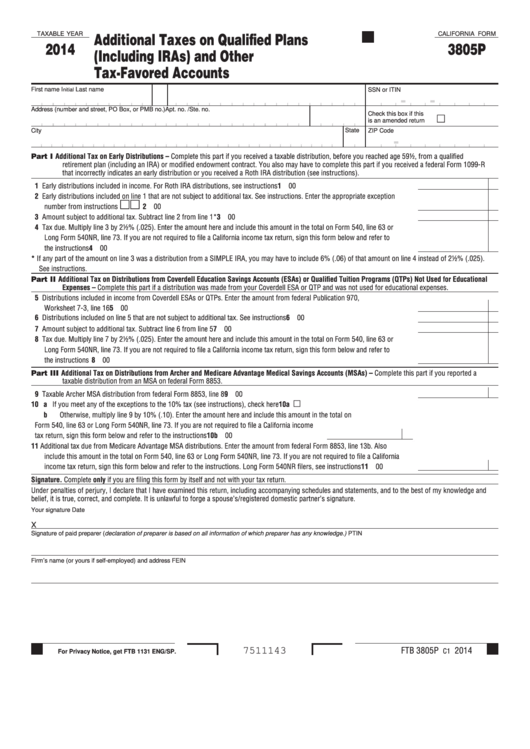

Additional Taxes on Qualified Plans

TAXABLE YEAR

CALIFORNIA FORM

2014

3805P

(Including IRAs) and Other

Tax-Favored Accounts

First name

I

Last name

SSN or ITIN

nitial

-

-

Address (number and street, PO Box, or PMB no.)

Apt. no. /Ste. no.

Check this box if this

is an amended return

City

State

ZIP Code

-

Part I

Additional Tax on Early Distributions – Complete this part if you received a taxable distribution, before you reached age 59½, from a qualified

retirement plan (including an IRA) or modified endowment contract. You also may have to complete this part if you received a federal Form 1099-R

that incorrectly indicates an early distribution or you received a Roth IRA distribution (see instructions).

1 Early distributions included in income. For Roth IRA distributions, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

2 Early distributions included on line 1 that are not subject to additional tax. See instructions. Enter the appropriate exception

number from instructions

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Amount subject to additional tax. Subtract line 2 from line 1*. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 Tax due. Multiply line 3 by 2½% (.025). Enter the amount here and include this amount in the total on Form 540, line 63 or

Long Form 540NR, line 73. If you are not required to file a California income tax return, sign this form below and refer to

the instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

00

* If any part of the amount on line 3 was a distribution from a SIMPLE IRA, you may have to include 6% (.06) of that amount on line 4 instead of 2½% (.025).

See instructions.

Part II Additional Tax on Distributions from Coverdell Education Savings Accounts (ESAs) or Qualified Tuition Programs (QTPs) Not Used for Educational

Expenses – Complete this part if a distribution was made from your Coverdell ESA or QTP and was not used for educational expenses.

5 Distributions included in income from Coverdell ESAs or QTPs. Enter the amount from federal Publication 970,

Worksheet 7-3, line 16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6 Distributions included on line 5 that are not subject to additional tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

7 Amount subject to additional tax. Subtract line 6 from line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

00

8 Tax due. Multiply line 7 by 2½% (.025). Enter the amount here and include this amount in the total on Form 540, line 63 or

Long Form 540NR, line 73. If you are not required to file a California income tax return, sign this form below and refer to

the instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

00

Part III Additional Tax on Distributions from Archer and Medicare Advantage Medical Savings Accounts (MSAs) – Complete this part if you reported a

taxable distribution from an MSA on federal Form 8853.

9 Taxable Archer MSA distribution from federal Form 8853, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9

00

10 a If you meet any of the exceptions to the 10% tax (see instructions), check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10a

b Otherwise, multiply line 9 by 10% (.10). Enter the amount here and include this amount in the total on

Form 540, line 63 or Long Form 540NR, line 73. If you are not required to file a California income

tax return, sign this form below and refer to the instructions . . . . . . . . . . . . . . . . . . . . . . . . 10b

00

11 Additional tax due from Medicare Advantage MSA distributions. Enter the amount from federal Form 8853, line 13b. Also

include this amount in the total on Form 540, line 63 or Long Form 540NR, line 73. If you are not required to file a California

income tax return, sign this form below and refer to the instructions. Long Form 540NR filers, see instructions. . . . . . . . . . . 11

00

Signature. Complete only if you are filing this form by itself and not with your tax return.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, correct, and complete. It is unlawful to forge a spouse’s/registered domestic partner’s signature.

Your signature

Date

X

Signature of paid preparer (declaration of preparer is based on all information of which preparer has any knowledge.)

PTIN

Firm’s name (or yours if self-employed) and address

FEIN

FTB 3805P

2014

7511143

C1

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1