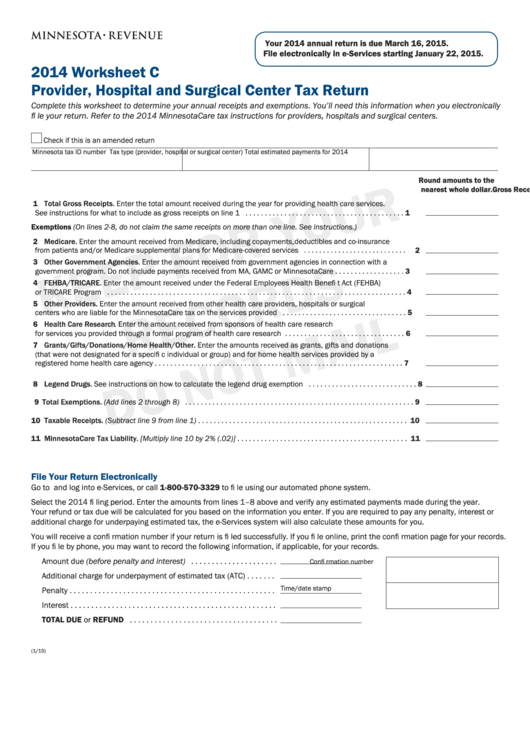

Worksheet C - Minnesota Provider, Hospital And Surgical Center Tax Return - 2014

ADVERTISEMENT

Your 2014 annual return is due March 16, 2015.

File electronically in e-Services starting January 22, 2015.

2014 Worksheet C

Provider, Hospital and Surgical Center Tax Return

Complete this worksheet to determine your annual receipts and exemptions. You’ll need this information when you electronically

fi le your return. Refer to the 2014 MinnesotaCare tax instructions for providers, hospitals and surgical centers.

Check if this is an amended return

Minnesota tax ID number

Tax type (provider, hospital or surgical center)

Total estimated payments for 2014

Round amounts to the

Gross Receipts (Amounts reported on lines 2–8 below must be included on line 1.)

nearest whole dollar.

1 Total Gross Receipts. Enter the total amount received during the year for providing health care services.

See instructions for what to include as gross receipts on line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Exemptions (On lines 2-8, do not claim the same receipts on more than one line. See instructions.)

2 Medicare. Enter the amount received from Medicare, including copayments, deductibles and co-insurance

from patients and/or Medicare supplemental plans for Medicare-covered services . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Other Government Agencies. Enter the amount received from government agencies in connection with a

government program. Do not include payments received from MA, GAMC or MinnesotaCare . . . . . . . . . . . . . . . . . . 3

4 FEHBA/TRICARE. Enter the amount received under the Federal Employees Health Benefi t Act (FEHBA)

or TRICARE Program . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Other Providers. Enter the amount received from other health care providers, hospitals or surgical

centers who are liable for the MinnesotaCare tax on the services provided . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Health Care Research. Enter the amount received from sponsors of health care research

for services you provided through a formal program of health care research . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Grants/Gifts/Donations/Home Health/Other. Enter the amounts received as grants, gifts and donations

(that were not designated for a specifi c individual or group) and for home health services provided by a

registered home health care agency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Legend Drugs. See instructions on how to calculate the legend drug exemption . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Total Exemptions. (Add lines 2 through 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Taxable Receipts. (Subtract line 9 from line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 MinnesotaCare Tax Liability. [Multiply line 10 by 2% (.02)] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

File Your Return Electronically

Go to and log into e-Services, or call 1-800-570-3329 to fi le using our automated phone system.

Select the 2014 fi ling period. Enter the amounts from lines 1–8 above and verify any estimated payments made during the year.

Your refund or tax due will be calculated for you based on the information you enter. If you are required to pay any penalty, interest or

additional charge for underpaying estimated tax, the e-Services system will also calculate these amounts for you.

You will receive a confi rmation number if your return is fi led successfully. If you fi le online, print the confi rmation page for your records.

If you fi le by phone, you may want to record the following information, if applicable, for your records.

Amount due (before penalty and interest) . . . . . . . . . . . . . . . . . . . . .

Confi rmation number

Additional charge for underpayment of estimated tax (ATC) . . . . . . .

Time/date stamp

Penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

TOTAL DUE or REFUND . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(1/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1