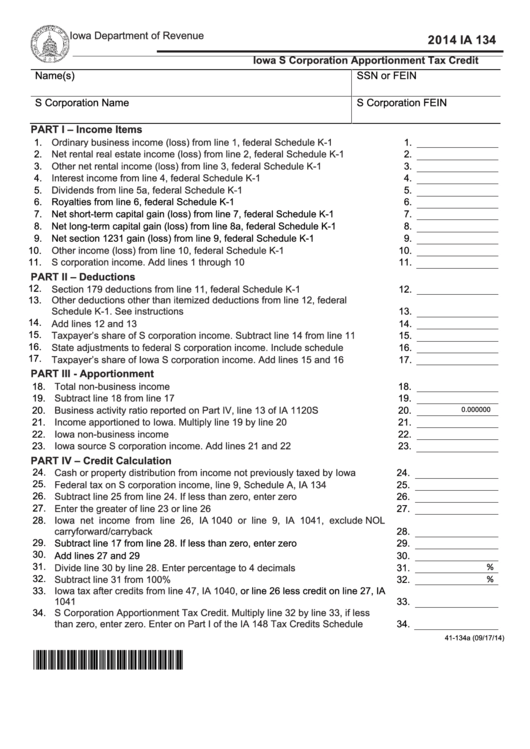

Iowa Department of Revenue

2014 IA 134

Iowa S Corporation Apportionment Tax Credit

Name(s)

SSN or FEIN

S Corporation Name

S Corporation FEIN

PART I – Income Items

1.

Ordinary business income (loss) from line 1, federal Schedule K-1 ......................

1.

2.

Net rental real estate income (loss) from line 2, federal Schedule K-1 ...................

2.

3.

Other net rental income (loss) from line 3, federal Schedule K-1 ..........................

3.

4.

Interest income from line 4, federal Schedule K-1 ................................................

4.

5.

Dividends from line 5a, federal Schedule K-1 .......................................................

5.

6. Royalties from line 6, federal Schedule K-1 ..........................................................

6.

7. Net short-term capital gain (loss) from line 7, federal Schedule K-1 .....................

7.

8. Net long-term capital gain (loss) from line 8a, federal Schedule K-1 ....................

8.

9. Net section 1231 gain (loss) from line 9, federal Schedule K-1 ............................

9.

10.

Other income (loss) from line 10, federal Schedule K-1 .......................................

10.

11.

S corporation income. Add lines 1 through 10 ......................................................

11.

PART II – Deductions

12.

Section 179 deductions from line 11, federal Schedule K-1 ................................

12.

13.

Other deductions other than itemized deductions from line 12, federal

Schedule K-1. See instructions ...........................................................................

13.

14.

Add lines 12 and 13 ...........................................................................................

14.

15.

Taxpayer’s share of S corporation income. Subtract line 14 from line 11 ...........

15.

16.

State adjustments to federal S corporation income. Include schedule ................

16.

17.

Taxpayer’s share of Iowa S corporation income. Add lines 15 and 16 ................

17.

PART III - Apportionment

18.

Total non-business income ..................................................................................

18.

19.

Subtract line 18 from line 17 .................................................................................

19.

20.

Business activity ratio reported on Part IV, line 13 of IA 1120S ............................

20.

0.000000

21.

Income apportioned to Iowa. Multiply line 19 by line 20 .......................................

21.

22.

Iowa non-business income ...................................................................................

22.

23.

Iowa source S corporation income. Add lines 21 and 22 ......................................

23.

PART IV – Credit Calculation

24.

Cash or property distribution from income not previously taxed by Iowa ..............

24.

25.

Federal tax on S corporation income, line 9, Schedule A, IA 134 .........................

25.

26.

Subtract line 25 from line 24. If less than zero, enter zero ...................................

26.

27.

Enter the greater of line 23 or line 26 ...................................................................

27.

28.

Iowa net income from line 26, IA 1040 or line 9, IA 1041, exclude NOL

carryforward/carryback ........................................................................................

28.

29. Subtract line 17 from line 28. If less than zero, enter zero ................................... 29.

30. Add lines 27 and 29 ............................................................................................. 30.

31.

Divide line 30 by line 28. Enter percentage to 4 decimals ....................................

31.

%

32.

Subtract line 31 from 100% ..................................................................................

32.

%

33.

Iowa tax after credits from line 47, IA 1040,

or line 26 less credit on line 27, IA

1041 ....................................................................................................................

33.

34.

S Corporation Apportionment Tax Credit. Multiply line 32 by line 33, if less

than zero, enter zero. Enter on Part I of the IA 148 Tax Credits Schedule ...........

34.

41-134a (09/17/14)

*1441134019999*

1

1 2

2