Form Ia 133 - Iowa New Jobs Tax Credit Worksheet - 2014

ADVERTISEMENT

Iowa Department of Revenue

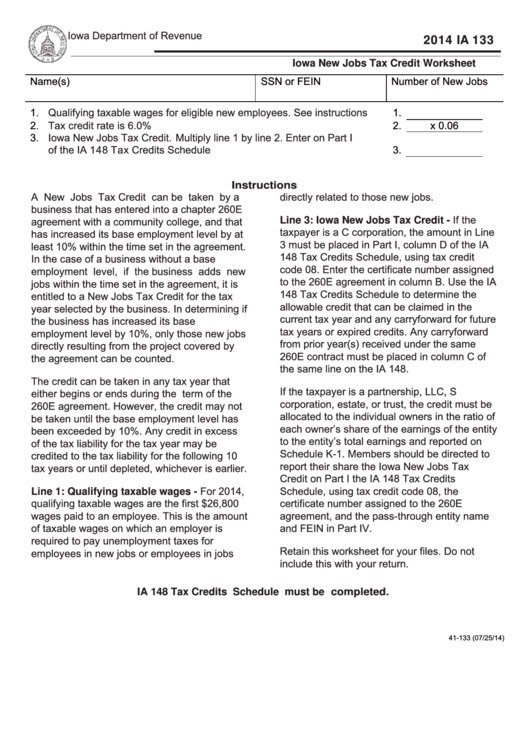

2014 IA 133

Iowa New Jobs Tax Credit Worksheet

Name(s)

SSN or FEIN

Number of New Jobs

1.

Qualifying taxable wages for eligible new employees. See instructions .....

1.

2.

Tax credit rate is 6.0%...............................................................................

2.

x 0.06

3.

Iowa New Jobs Tax Credit. Multiply line 1 by line 2. Enter on Part I

of the IA 148 Tax Credits Schedule ................................................

3.

Instructions

A New Jobs Tax Credit can be taken by a

directly related to those new jobs.

business that has entered into a chapter 260E

Line 3: Iowa New Jobs Tax Credit - If the

agreement with a community college, and that

taxpayer is a C corporation, the amount in Line

has increased its base employment level by at

3 must be placed in Part I, column D of the IA

least 10% within the time set in the agreement.

148 Tax Credits Schedule, using tax credit

In the case of a business without a base

code 08. Enter the certificate number assigned

employment level, if the business adds new

to the 260E agreement in column B. Use the IA

jobs within the time set in the agreement, it is

148 Tax Credits Schedule to determine the

entitled to a New Jobs Tax Credit for the tax

allowable credit that can be claimed in the

year selected by the business. In determining if

current tax year and any carryforward for future

the

business

has

increased

its

base

tax years or expired credits. Any carryforward

employment level by 10%, only those new jobs

from prior year(s) received under the same

directly resulting from the project covered by

260E contract must be placed in column C of

the agreement can be counted.

the same line on the IA 148.

The credit can be taken in any tax year that

If the taxpayer is a partnership, LLC, S

either begins or ends during the term of the

corporation, estate, or trust, the credit must be

260E agreement. However, the credit may not

allocated to the individual owners in the ratio of

be taken until the base employment level has

each owner’s share of the earnings of the entity

been exceeded by 10%. Any credit in excess

to the entity’s total earnings and reported on

of the tax liability for the tax year may be

Schedule K-1. Members should be directed to

credited to the tax liability for the following 10

report their share the Iowa New Jobs Tax

tax years or until depleted, whichever is earlier.

Credit on Part I the IA 148 Tax Credits

Line 1: Qualifying taxable wages - For 2014,

Schedule, using tax credit code 08, the

qualifying taxable wages are the first $26,800

certificate number assigned to the 260E

wages paid to an employee. This is the amount

agreement, and the pass-through entity name

of taxable wages on which an employer is

and FEIN in Part IV.

required to pay unemployment taxes for

Retain this worksheet for your files. Do not

employees in new jobs or employees in jobs

include this with your return.

IA 148 Tax Credits Schedule must be completed.

41-133 (07/25/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1