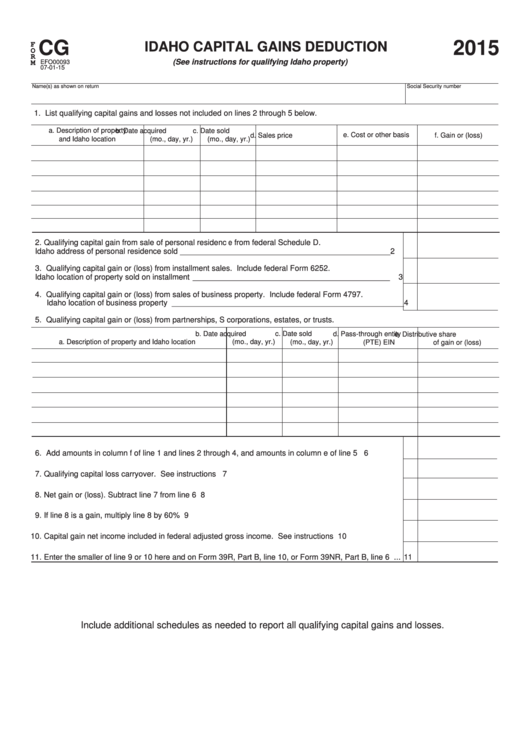

2015

CG

IDAHO CAPITAL GAINS DEDUCTION

F

O

R

(See instructions for qualifying Idaho property)

M

EFO00093

07-01-15

Social Security number

Name(s) as shown on return

1. List qualifying capital gains and losses not included on lines 2 through 5 below.

a. Description of property

b. Date acquired

c. Date sold

d. Sales price

e. Cost or other basis

f. Gain or (loss)

and Idaho location

(mo., day, yr.)

(mo., day, yr.)

2. Qualifying capital gain from sale of personal residence from federal Schedule D.

Idaho address of personal residence sold ________________________________________________

2

3. Qualifying capital gain or (loss) from installment sales. Include federal Form 6252.

Idaho location of property sold on installment _____________________________________________

3

4. Qualifying capital gain or (loss) from sales of business property. Include federal Form 4797.

Idaho location of business property _____________________________________________________

4

5. Qualifying capital gain or (loss) from partnerships, S corporations, estates, or trusts.

b. Date acquired

c. Date sold

d. Pass-through entity

e. Distributive share

a. Description of property and Idaho location

(mo., day, yr.)

(mo., day, yr.)

(PTE) EIN

of gain or (loss)

6. Add amounts in column f of line 1 and lines 2 through 4, and amounts in column e of line 5 .................

6

7. Qualifying capital loss carryover. See instructions ..................................................................................

7

8. Net gain or (loss). Subtract line 7 from line 6 ............................................................................................

8

9. If line 8 is a gain, multiply line 8 by 60% ...................................................................................................

9

10. Capital gain net income included in federal adjusted gross income. See instructions ............................. 10

11. Enter the smaller of line 9 or 10 here and on Form 39R, Part B, line 10, or Form 39NR, Part B, line 6 ... 11

Include additional schedules as needed to report all qualifying capital gains and losses.

1

1 2

2 3

3