Instructions For Form Ia 1120s - Income Tax Return For S Corporations - 2014

ADVERTISEMENT

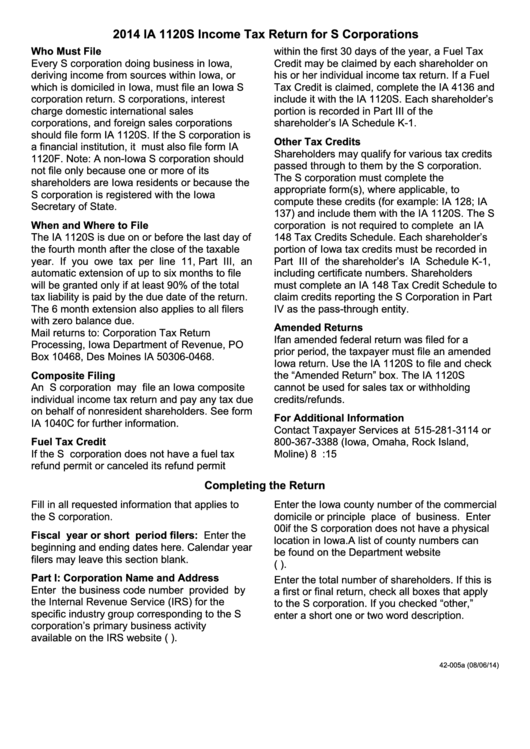

2014 IA 1120S Income Tax Return for S Corporations

Who Must File

within the first 30 days of the year, a Fuel Tax

Every S corporation doing business in Iowa,

Credit may be claimed by each shareholder on

deriving income from sources within Iowa, or

his or her individual income tax return. If a Fuel

which is domiciled in Iowa, must file an Iowa S

Tax Credit is claimed, complete the IA 4136 and

corporation return. S corporations, interest

include it with the IA 1120S. Each shareholder’s

charge

domestic

international

sales

portion

is

recorded

in

Part

III

of

the

corporations, and foreign sales corporations

shareholder’s IA Schedule K-1.

should file form IA 1120S. If the S corporation is

Other Tax Credits

a financial institution, it must also file form IA

Shareholders may qualify for various tax credits

1120F. Note: A non-Iowa S corporation should

passed through to them by the S corporation.

not file only because one or more of its

The

S

corporation

must

complete

the

shareholders are Iowa residents or because the

appropriate

form(s),

where

applicable,

to

S corporation is registered with the Iowa

compute these credits (for example: IA 128; IA

Secretary of

State.

137) and include them with the IA 1120S. The S

When and Where to File

corporation is not required to complete an IA

The IA 1120S is due on or before the last day of

148 Tax Credits Schedule. Each shareholder’s

the fourth month after the close of the taxable

portion of Iowa tax credits must be recorded in

year. If you owe tax per line 11, Part III, an

Part III of the shareholder’s IA Schedule K-1,

automatic extension of up to six months to file

including

certificate

numbers.

Shareholders

will be granted only if at least 90% of the total

must complete an IA 148 Tax Credit Schedule to

tax liability is paid by the due date of the return.

claim credits reporting the S Corporation in Part

The 6 month extension also applies to all filers

IV as the pass-through entity.

with zero balance due.

Amended Returns

Mail

returns

to:

Corporation

Tax

Return

If an amended federal return was filed for a

Processing, Iowa Department of Revenue, PO

prior period, the taxpayer must file an amended

Box 10468, Des Moines IA 50306-0468.

Iowa return. Use the IA 1120S to file and check

Composite Filing

the “Amended Return” box. The IA 1120S

An S corporation may file an Iowa composite

cannot be used for sales tax or withholding

individual income tax return and pay any tax due

credits/refunds.

on behalf of nonresident shareholders. See form

For Additional Information

IA 1040C for further information.

Contact Taxpayer Services at 515-281-3114 or

Fuel Tax Credit

800-367-3388 (Iowa, Omaha, Rock Island,

If the S corporation does not have a fuel tax

Moline) 8 a.m. - 4:15 p.m. CT or email

refund permit or canceled its refund permit

idr@iowa.gov

Completing the Return

Fill in all requested information that applies to

Enter the Iowa county number of the commercial

the S corporation.

domicile or principle place of business. Enter

00 if the S corporation does not have a physical

Fiscal year or short period filers: Enter the

location in Iowa. A list of county numbers can

beginning and ending dates here. Calendar year

be

found

on

the

Department

website

filers may leave this section blank.

( ).

Part I: Corporation Name and Address

Enter the total number of shareholders. If this is

Enter the business code number provided by

a first or final return, check all boxes that apply

the Internal Revenue Service (IRS) for the

to the S corporation. If you checked “other,”

specific industry group corresponding to the S

enter a short one or two word description.

corporation’s

primary

business

activity

available on the IRS website ( ).

42-005a (08/06/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5