Maine Capital Investment Credit Worksheet For Tax Year 2015

ADVERTISEMENT

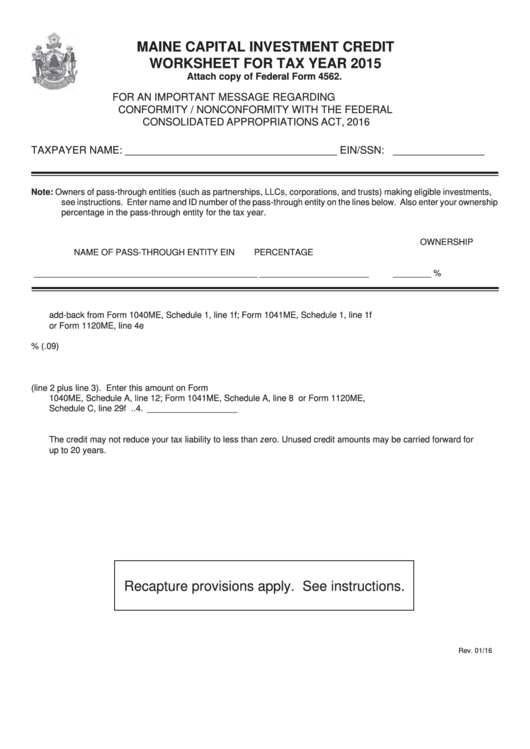

MAINE CAPITAL INVESTMENT CREDIT

WORKSHEET FOR TAX YEAR 2015

Attach copy of Federal Form 4562.

CLICK HERE FOR AN IMPORTANT MESSAGE REGARDING

CONFORMITY / NONCONFORMITY WITH THE FEDERAL

CONSOLIDATED APPROPRIATIONS ACT, 2016

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (such as partnerships, LLCs, corporations, and trusts) making eligible investments,

see instructions. Enter name and ID number of the pass-through entity on the lines below. Also enter your ownership

percentage in the pass-through entity for the tax year.

OWNERSHIP

NAME OF PASS-THROUGH ENTITY

EIN

PERCENTAGE

_______________________________________________

_______________________

________ %

1.

Enter on this line the amount of Maine Capital Investment Credit bonus depreciation

add-back from Form 1040ME, Schedule 1, line 1f; Form 1041ME, Schedule 1, line 1f

or Form 1120ME, line 4e .................................................................................................... 1. ___________________

2.

Current year credit. Multiply line 1 by 9% (.09) ................................................................. 2. ___________________

3.

Enter the amount of unused credit from previous years .................................................... 3. ___________________

4.

Total available credit (line 2 plus line 3). Enter this amount on Form

1040ME, Schedule A, line 12; Form 1041ME, Schedule A, line 8 or Form 1120ME,

Schedule C, line 29f ........................................................................................................... 4. ___________________

The credit may not reduce your tax liability to less than zero. Unused credit amounts may be carried forward for

up to 20 years.

Recapture provisions apply. See instructions.

Rev. 01/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4