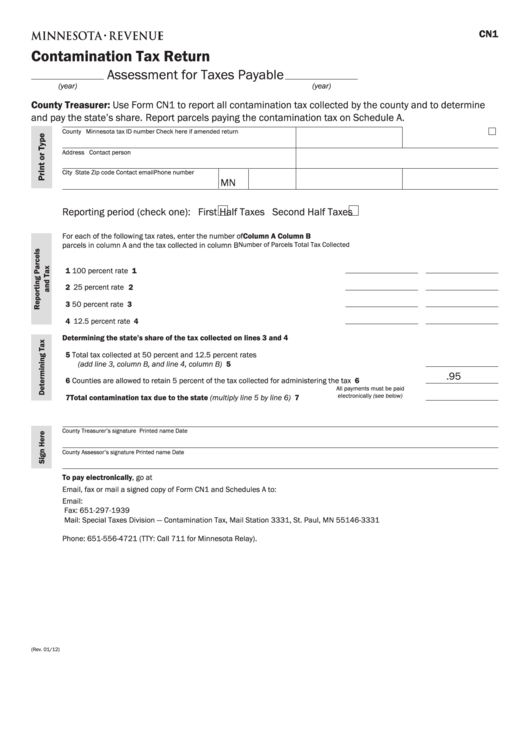

CN1

Contamination Tax Return

Assessment for Taxes Payable

(year)

(year)

County Treasurer: Use Form CN1 to report all contamination tax collected by the county and to determine

and pay the state’s share . Report parcels paying the contamination tax on Schedule A .

County

Minnesota tax ID number

Check here if amended return

Address

Contact person

City

State

Zip code

Contact email

Phone number

MN

Reporting period (check one):

First Half Taxes

Second Half Taxes

For each of the following tax rates, enter the number of

Column A

Column B

Number of Parcels

Total Tax Collected

parcels in column A and the tax collected in column B

(round to nearest dollar)

1 100 percent rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 25 percent rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 50 percent rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 12 .5 percent rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Determining the state’s share of the tax collected on lines 3 and 4

5 Total tax collected at 50 percent and 12 .5 percent rates

(add line 3, column B, and line 4, column B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.95

6 Counties are allowed to retain 5 percent of the tax collected for administering the tax . . . . . . . . . . . . . . . 6

All payments must be paid

electronically (see below)

7 Total contamination tax due to the state (multiply line 5 by line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

County Treasurer’s signature

Printed name

Date

County Assessor’s signature

Printed name

Date

To pay electronically, go at www .revenue .state .mn .us and login to e-Services .

Email, fax or mail a signed copy of Form CN1 and Schedules A to:

Email: contamination .tax@state .mn .us

Fax: 651-297-1939

Mail: Special Taxes Division — Contamination Tax, Mail Station 3331, St . Paul, MN 55146-3331

Phone: 651-556-4721 (TTY: Call 711 for Minnesota Relay) .

(Rev . 01/12)

1

1 2

2