20 __

*VAI301113888*

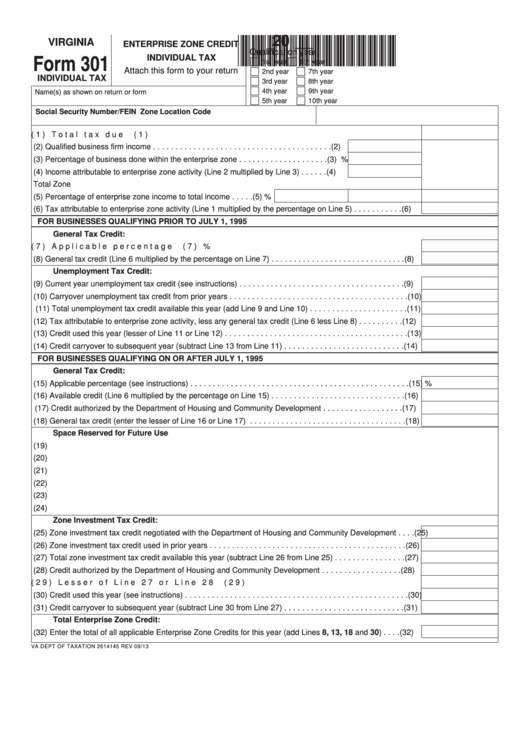

VIRGINIA

ENTERPRISE ZONE CREDIT

Qualification year

Form 301

INDIVIDUAL TAX

j

j

1st year

6th year

Attach this form to your return

j

j

2nd year

7th year

INDIVIDUAL TAX

j

j

3rd year

8th year

j

j

4th year

9th year

Name(s) as shown on return or form

j

j

5th year

10th year

Social Security Number/FEIN

Zone Location Code

(1) Total tax due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1)

(2) Qualified business firm income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2)

(3) Percentage of business done within the enterprise zone . . . . . . . . . . . . . . . . . . . . (3)

%

(4) Income attributable to enterprise zone activity (Line 2 multiplied by Line 3) . . . . . . (4)

Total

Zone

(5) Percentage of enterprise zone income to total income . . . . . (5)

%

(6) Tax attributable to enterprise zone activity (Line 1 multiplied by the percentage on Line 5) . . . . . . . . . . . (6)

FOR BUSINESSES QUALIFYING PRIOR TO JULY 1, 1995

General Tax Credit:

(7) Applicable percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7)

%

(8) General tax credit (Line 6 multiplied by the percentage on Line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8)

Unemployment Tax Credit:

(9) Current year unemployment tax credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9)

(10) Carryover unemployment tax credit from prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10)

(11) Total unemployment tax credit available this year (add Line 9 and Line 10) . . . . . . . . . . . . . . . . . . . . . . (11)

(12) Tax attributable to enterprise zone activity, less any general tax credit (Line 6 less Line 8) . . . . . . . . . . (12)

(13) Credit used this year (lesser of Line 11 or Line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (13)

(14) Credit carryover to subsequent year (subtract Line 13 from Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . (14)

FOR BUSINESSES QUALIFYING ON OR AFTER JULY 1, 1995

General Tax Credit:

(15) Applicable percentage (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (15)

%

(16) Available credit (Line 6 multiplied by the percentage on Line 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (16)

(17) Credit authorized by the Department of Housing and Community Development . . . . . . . . . . . . . . . . . . (17)

(18) General tax credit (enter the lesser of Line 16 or Line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (18)

Space Reserved for Future Use

(19)

(20)

(21)

(22)

(23)

(24)

Zone Investment Tax Credit:

(25) Zone investment tax credit negotiated with the Department of Housing and Community Development . . . . (25)

(26) Zone investment tax credit used in prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (26)

(27) Total zone investment tax credit available this year (subtract Line 26 from Line 25) . . . . . . . . . . . . . . . . (27)

(28) Credit authorized by the Department of Housing and Community Development . . . . . . . . . . . . . . . . . . (28)

(29) Lesser of Line 27 or Line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (29)

(30) Credit used this year (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (30)

(31) Credit carryover to subsequent year (subtract Line 30 from Line 27) . . . . . . . . . . . . . . . . . . . . . . . . . . . (31)

Total Enterprise Zone Credit:

(32) Enter the total of all applicable Enterprise Zone Credits for this year (add Lines 8, 13, 18 and 30) . . . . (32)

VA DEPT OF TAXATION 2614145

REV 09/13

1

1 2

2