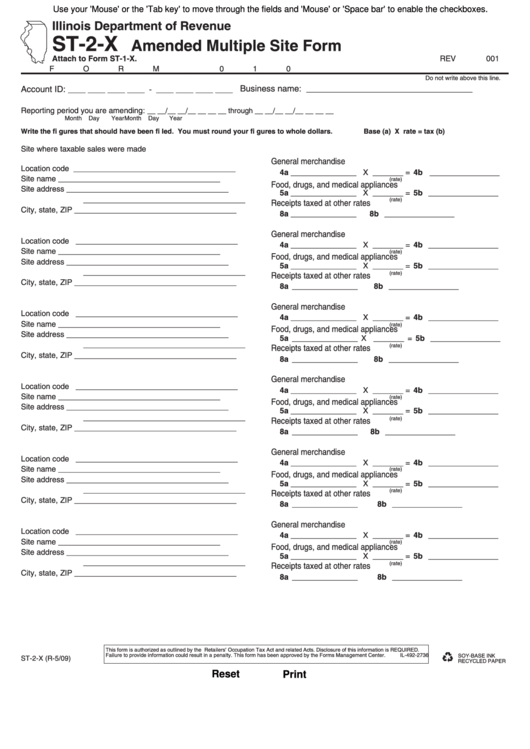

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

ST-2-X

Amended Multiple Site Form

Attach to Form ST-1-X.

REV

001

FORM

010

Do not write above this line.

Business name: ___________________________________

Account ID:

____ ____ ____ ____ - ____ ____ ____ ____

Reporting period you are amending:

__ __/__ __/__ __ __ __ through __ __/__ __/__ __ __ __

Month

Day

Year

Month

Day

Year

Write the fi gures that should have been fi led. You must round your fi gures to whole dollars.

Base (a) X rate = tax (b)

Site where taxable sales were made

General merchandise

Location code

_____________________________________

4a _______________

X _______ = 4b ________________

Site name

_____________________________________

(rate)

Food, drugs, and medical appliances

Site address

_____________________________________

5a _______________

X _______ = 5b ________________

_____________________________________

(rate)

Receipts taxed at other rates

City, state, ZIP

_____________________________________

8a _______________

8b ________________

General merchandise

Location code

_____________________________________

4a _______________

X _______ = 4b ________________

Site name

_____________________________________

(rate)

Food, drugs, and medical appliances

Site address

_____________________________________

5a _______________

X _______ = 5b ________________

_____________________________________

(rate)

Receipts taxed at other rates

City, state, ZIP

_____________________________________

8a _______________

8b ________________

General merchandise

Location code

_____________________________________

4a _______________

X _______ = 4b ________________

Site name

_____________________________________

(rate)

Food, drugs, and medical appliances

Site address

_____________________________________

5a _______________

X _______ = 5b ________________

_____________________________________

(rate)

Receipts taxed at other rates

City, state, ZIP

_____________________________________

8a _______________

8b ________________

General merchandise

Location code

_____________________________________

4a _______________

X _______ = 4b ________________

Site name

_____________________________________

(rate)

Food, drugs, and medical appliances

Site address

_____________________________________

5a _______________

X _______ = 5b ________________

_____________________________________

(rate)

Receipts taxed at other rates

City, state, ZIP

_____________________________________

8a _______________

8b ________________

General merchandise

Location code

_____________________________________

4a _______________

X _______ = 4b ________________

Site name

_____________________________________

(rate)

Food, drugs, and medical appliances

Site address

_____________________________________

5a _______________

X _______ = 5b ________________

_____________________________________

(rate)

Receipts taxed at other rates

City, state, ZIP

_____________________________________

8a _______________

8b ________________

General merchandise

Location code

_____________________________________

4a _______________

X _______ = 4b ________________

Site name

_____________________________________

(rate)

Food, drugs, and medical appliances

Site address

_____________________________________

5a _______________

X _______ = 5b ________________

_____________________________________

(rate)

Receipts taxed at other rates

City, state, ZIP

_____________________________________

8a _______________

8b ________________

This form is authorized as outlined by the Retailers’ Occupation Tax Act and related Acts. Disclosure of this information is REQUIRED.

Failure to provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-2736

SOY-BASE INK

ST-2-X (R-5/09)

RECYCLED PAPER

Reset

Print

1

1