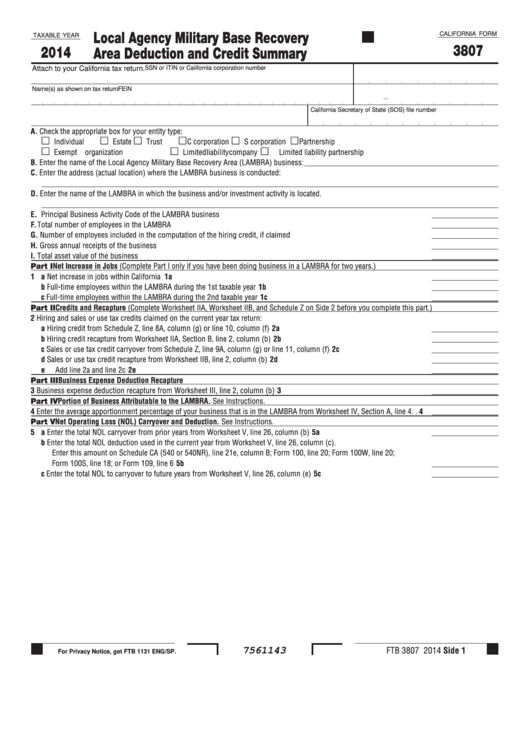

Form 3807 - California Local Agency Military Base Recovery Area Deduction And Credit Summary - 2014

ADVERTISEMENT

Local Agency Military Base Recovery

CALIFORNIA FORM

TAXABLE YEAR

3807

2014

Area Deduction and Credit Summary

SSN or ITIN or California corporation number

Attach to your California tax return.

Name(s) as shown on tax return

FEIN

California Secretary of State (SOS) file number

A. Check the appropriate box for your entity type:

Individual

Estate

Trust

C corporation

S corporation

Partnership

Exempt organization

Limited liability company

Limited liability partnership

B. Enter the name of the Local Agency Military Base Recovery Area (LAMBRA) business:

C. Enter the address (actual location) where the LAMBRA business is conducted:

D. Enter the name of the LAMBRA in which the business and/or investment activity is located .

E. Principal Business Activity Code of the LAMBRA business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F. Total number of employees in the LAMBRA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

G. Number of employees included in the computation of the hiring credit, if claimed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

H. Gross annual receipts of the business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I. Total asset value of the business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part I Net Increase in Jobs (Complete Part I only if you have been doing business in a LAMBRA for two years .)

1 a Net increase in jobs within California . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a

b Full-time employees within the LAMBRA during the 1st taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b

c Full-time employees within the LAMBRA during the 2nd taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c

Part II Credits and Recapture (Complete Worksheet IIA, Worksheet IIB, and Schedule Z on Side 2 before you complete this part .)

2 Hiring and sales or use tax credits claimed on the current year tax return:

a Hiring credit from Schedule Z, line 8A, column (g) or line 10, column (f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b Hiring credit recapture from Worksheet IIA, Section B, line 2, column (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

c Sales or use tax credit carryover from Schedule Z, line 9A, column (g) or line 11, column (f) . . . . . . . . . . . . . . . . . . . . . 2c

d Sales or use tax credit recapture from Worksheet IIB, line 2, column (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d

e Add line 2a and line 2c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2e

Part III Business Expense Deduction Recapture

3 Business expense deduction recapture from Worksheet III, line 2, column (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Part IV Portion of Business Attributable to the LAMBRA. See Instructions .

4 Enter the average apportionment percentage of your business that is in the LAMBRA from Worksheet IV, Section A, line 4 . . 4

Part V Net Operating Loss (NOL) Carryover and Deduction. See Instructions .

5 a Enter the total NOL carryover from prior years from Worksheet V, line 26, column (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . 5a

b Enter the total NOL deduction used in the current year from Worksheet V, line 26, column (c) .

Enter this amount on Schedule CA (540 or 540NR), line 21e, column B; Form 100, line 20; Form 100W, line 20;

Form 100S, line 18; or Form 109, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b

c Enter the total NOL to carryover to future years from Worksheet V, line 26, column (e) . . . . . . . . . . . . . . . . . . . . . . . . . . 5c

FTB 3807 2014 Side 1

7561143

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2