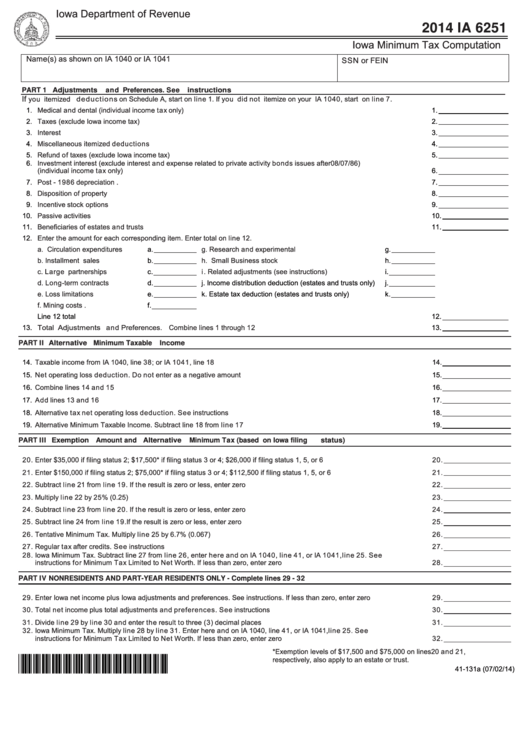

Iowa Department of Revenue

2014 IA 6251

Iowa Minimum Tax Computation

Name(s) as shown on IA 1040 or IA 1041

SSN or FEIN

PART 1 Adjustments and Preferences. See instructions

If

you itemized deductions on Schedule A, start on line 1. If you did not itemize on your IA 1040, start on line 7.

1.

Medical and dental (individual income tax only) ..................................................................................................

1.

2.

Taxes (exclude Iowa income tax) ......................................................................................................................

2.

3.

Interest .................................................................................................................................................................................

3.

4.

Miscellaneous itemized deductions ..................................................................................................................

4.

5.

Refund of taxes (exclude Iowa income tax) ........................................................................................................

5.

6.

Investment interest (exclude interest and expense related to private activity bonds issues after 08/07/86)

(individual income tax only) ...........................................................................................................................

6.

7.

Post - 1986 depreciation .................................................................................................................................

7.

8.

Disposition of property ....................................................................................................................................

8.

9.

Incentive stock options....................................................................................................................................

9.

10.

Passive activities ...........................................................................................................................................

10.

11.

Beneficiaries of estates and trusts ..................................................................................................................

11.

12.

Enter the amount for each corresponding item. Enter total on line 12.

a. Circulation expenditures .............

a.

g. Research and experimental .......................................

g.

b. Installment sales .......................

b.

h. Small Business stock ..............................................

h.

c. Large partnerships ....................

c.

i . Related adjustments (see instructions) ...............

i.

d. Long-term contracts ...................

d.

j. Income distribution deduction (estates and trusts only)

j.

e. Loss limitations ...........................

e.

k. Estate tax deduction (estates and trusts only) .............. k.

f. Mining costs .................................

f.

Line 12 total ................................................................................................................................................................................... 12.

13.

Total Adjustments and Preferences. Combine lines 1 through 12 ......................................................................

13.

PART II Alternative Minimum Taxable Income

14.

Taxable income from IA 1040, line 38; or IA 1041, line 18 ...................................................................................................

14.

15.

Net operating loss deduction. Do not enter as a negative amount ...........................................................................

15.

16.

Combine lines 14 and 15 ...................................................................................................................................

16.

17.

Add lines 13 and 16 ..........................................................................................................................................

17.

18.

Alternative tax net operating loss deduction. See instructions ...............................................................................

18.

19.

Alternative Minimum Taxable Income. Subtract line 18 from line 17 .........................................................................

19.

PART III Exemption Amount an d Alternative Minimum Tax (based on Iowa filing status)

20. Enter $35,000 if filing status 2; $17,500* if filing status 3 or 4; $26,000 if filing status 1, 5, or 6 ....................................... 20.

21. Enter $150,000 if filing status 2; $75,000* if filing status 3 or 4; $112,500 if filing status 1, 5, or 6 ............................................... 21.

22. Subtract line 21 from line 19. If the result is zero or less, enter zero .................................................................. 22.

23. Multiply line 22 by 25% (0.25) ............................................................................................................................. 23.

24. Subtract line 23 from line 20. If the result is zero or less, enter zero .................................................................. 24.

25. Subtract line 24 from line 19.If the result is zero or less, enter zero ......................................................................................... 25.

26. Tentative Minimum Tax. Multiply line 25 by 6.7% (0.067) ....................................................................................... 26.

27. Regular tax after credits. See instructions .......................................................................................................... 27.

28. Iowa Minimum Tax. Subtract line 27 from line 26, enter here and on IA 1040, line 41, or IA 1041, line 25. See

instructions for Minimum Tax Limited to Net Worth. If less than zero, enter zero ................................................. 28.

PART IV NONRESIDENTS AND PART-YEAR RESIDENTS ONLY - Complete lines 29 - 32

29. Enter Iowa net income plus Iowa adjustments and preferences. See instructions. If less than zero, enter zero .................................... 29.

30. Total net income plus total adjustments and preferences. See instructions ............................................................. 30.

31. Divide line 29 by line 30 and enter the result to three (3) decimal places .................................................................. 31.

32. Iowa Minimum Tax. Multiply line 28 by line 31. Enter here and on IA 1040, line 41, or IA 1041, line 25. See

instructions for Minimum Tax Limited to Net Worth. If less than zero, enter zero ................................................. 32.

*Exemption levels of $17,500 and $75,000 on lines20 and 21,

*1441131019999*

r espectively, also apply to an estate or trust.

41-131a (07/02/14)

1

1 2

2