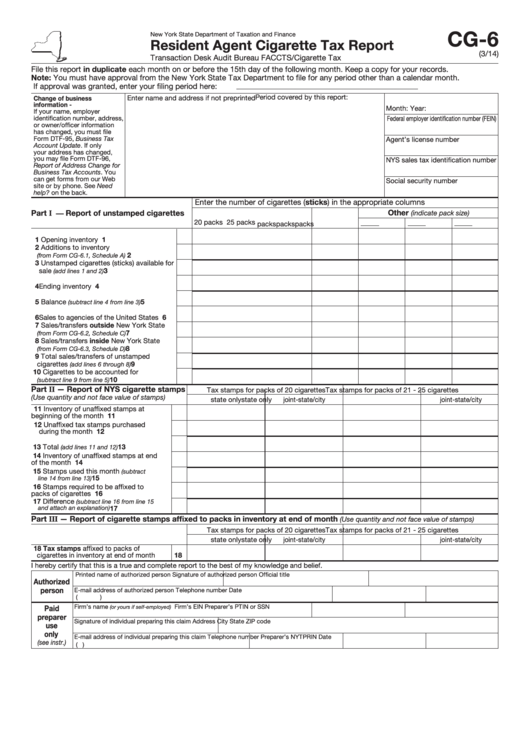

Form Cg-6 - Resident Agent Cigarette Tax Report

ADVERTISEMENT

CG-6

New York State Department of Taxation and Finance

Resident Agent Cigarette Tax Report

(3/14)

Transaction Desk Audit Bureau FACCTS/Cigarette Tax

File this report in duplicate each month on or before the 15th day of the following month. Keep a copy for your records.

Note: You must have approval from the New York State Tax Department to file for any period other than a calendar month.

If approval was granted, enter your filing period here:

Period covered by this report:

Change of business

Enter name and address if not preprinted

information -

Month:

Year:

If your name, employer

identification number, address,

Federal employer identification number (FEIN)

or owner/officer information

has changed, you must file

Form DTF-95, Business Tax

Agent’s license number

Account Update. If only

your address has changed,

you may file Form DTF-96,

NYS sales tax identification number

Report of Address Change for

Business Tax Accounts. You

can get forms from our Web

Social security number

site or by phone. See Need

help? on the back.

Enter the number of cigarettes (sticks) in the appropriate columns

Other

Part I — Report of unstamped cigarettes

(indicate pack size)

20 packs

25 packs

packs

packs

packs

1 Opening inventory .......................................

1

2 Additions to inventory

..................

2

(from Form CG-6.1, Schedule A)

3 Unstamped cigarettes (sticks) available for

sale

...............................

3

(add lines 1 and 2)

4 Ending inventory .........................................

4

5 Balance

.................

5

(subtract line 4 from line 3)

6 Sales to agencies of the United States .......

6

7 Sales/transfers outside New York State

7

...................

(from Form CG-6.2, Schedule C)

8 Sales/transfers inside New York State

8

...................

(from Form CG-6.3, Schedule D)

9 Total sales/transfers of unstamped

9

cigarettes

................

(add lines 6 through 8)

10 Cigarettes to be accounted for

........................... 10

(subtract line 9 from line 5)

Part II — Report of NYS cigarette stamps

Tax stamps for packs of 20 cigarettes

Tax stamps for packs of 21 - 25 cigarettes

(Use quantity and not face value of stamps)

state only

joint-state/city

state only

joint-state/city

11 Inventory of unaffixed stamps at

beginning of the month ....................... 11

12 Unaffixed tax stamps purchased

during the month ................................ 12

13 Total

......................... 13

(add lines 11 and 12)

14 Inventory of unaffixed stamps at end

of the month ....................................... 14

15 Stamps used this month

(subtract

................................ 15

line 14 from line 13)

16 Stamps required to be affixed to

packs of cigarettes ............................. 16

17 Difference

(subtract line 16 from line 15

....................... 17

and attach an explanation)

Part III — Report of cigarette stamps affixed to packs in inventory at end of month

(Use quantity and not face value of stamps)

Tax stamps for packs of 20 cigarettes

Tax stamps for packs of 21 - 25 cigarettes

state only

joint-state/city

state only

joint-state/city

18 Tax stamps affixed to packs of

cigarettes in inventory at end of month 18

I hereby certify that this is a true and complete report to the best of my knowledge and belief.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

Paid

(or yours if self-employed)

preparer

Signature of individual preparing this claim

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this claim

Telephone number

Preparer’s NYTPRIN

Date

(see instr.)

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2