Print Form

Clear Form

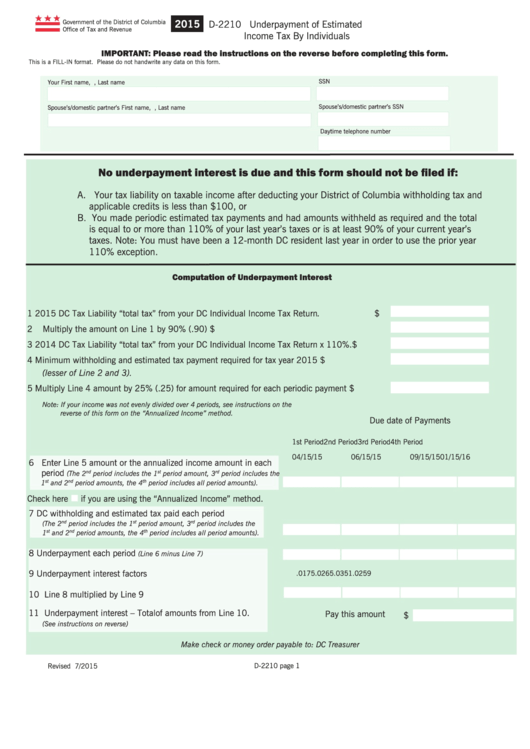

2015

Government of the District of Columbia

D-2210 Underpayment of Estimated

Office of Tax and Revenue

Income Tax By Individuals

IMPORTANT: Please read the instructions on the reverse before completing this form.

This is a FILL-IN format. Please do not handwrite any data on this form.

SSN

Your First name, M.I., Last name

Spouse’s/domestic partner’s SSN

Spouse’s/domestic partner’s First name, M.I., Last name

Daytime telephone number

No underpayment interest is due and this form should not be filed if:

A. Your tax liability on taxable income after deducting your District of Columbia withholding tax and

applicable credits is less than $100, or

B. You made periodic estimated tax payments and had amounts withheld as required and the total

is equal to or more than 110% of your last year’s taxes or is at least 90% of your current year’s

taxes. Note: You must have been a 12-month DC resident last year in order to use the prior year

110% exception.

Computation of Underpayment Interest

1

2015 DC Tax Liability “total tax” from your DC Individual Income Tax Return.

$

2

Multiply the amount on Line 1 by 90% (.90)

$

3

2014 DC Tax Liability “total tax” from your DC Individual Income Tax Return x 110%.

$

4

Minimum withholding and estimated tax payment required for tax year 2015

$

(lesser of Line 2 and 3)

.

5

Multiply Line 4 amount by 25% (.25) for amount required for each periodic payment

$

Note: If your income was not evenly divided over 4 periods, see instructions on the

reverse of this form on the “Annualized Income” method.

Due date of Payments

1st Period

2nd Period

3rd Period

4th Period

04/15/15

06/15/15

09/15/15

01/15/16

6 Enter Line 5 amount or the annualized income amount in each

period

nd

st

rd

(The 2

period includes the 1

period amount, 3

period includes the

1

st

and 2

nd

period amounts, the 4

th

period includes all period amounts).

Check here

if you are using the “Annualized Income” method.

7 DC withholding and estimated tax paid each period

nd

st

rd

(The 2

period includes the 1

period amount, 3

period includes the

st

nd

th

1

and 2

period amounts, the 4

period includes all period amounts).

8 Underpayment each period

(Line 6 minus Line 7)

9 Underpayment interest factors

.0175

.0265

.0351

.0259

10 Line 8 multiplied by Line 9

11 Underpayment interest – Total of amounts from Line 10.

Pay this amount

$

(See instructions on reverse)

Make check or money order payable to: DC Treasurer

Revised 7/2015

D-2210 page 1

1

1 2

2