Print

Clear

l

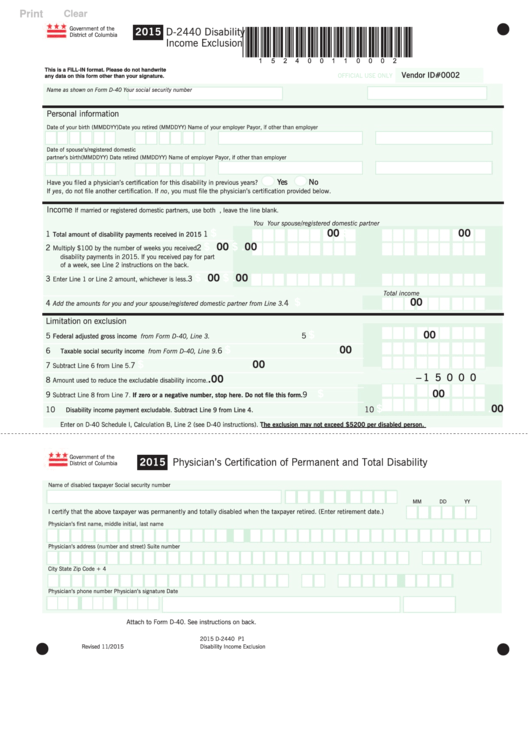

Government of the

2015

D-2440 Disability

*152400110002*

District of Columbia

Income Exclusion

This is a FILL-IN format. Please do not handwrite

Vendor ID#0002

OFFICIAL USE ONLY

any data on this form other than your signature.

Name as shown on Form D-40

Your social security number

Personal information

Date of your birth (MMDDYY)

Date you retired (MMDDYY)

Name of your employer

Payor, if other than employer

Date of spouse’s/registered domestic

partner’s birth(MMDDYY)

Date retired (MMDDYY)

Name of employer

Payor, if other than employer

Yes

No

Have you filed a physician’s certification for this disability in previous years?

If yes, do not file another certification. If no, you must file the physician’s certification provided below.

Income

If married or registered domestic partners, use both columns.

Round cents to the nearest dollar. If amount is zero, leave the line blank.

You

Your spouse/registered domestic partner

$

.00

$

.00

1

1

Total amount of disability payments received in 2015

$

.00

$

.00

2

2

Multiply $100 by the number of weeks you received

disability payments in 2015. If you received pay for part

of a week, see Line 2 instructions on the back.

$

.00

$

.00

3

3

Enter Line 1 or Line 2 amount, whichever is less.

Total income

$

.00

4

4

Add the amounts for you and your spouse/registered domestic partner from Line 3.

Limitation on exclusion

$

.00

5

5

Federal adjusted gross income from Form D-40, Line 3.

$

.00

6

6

Taxable social security income from Form D-40, Line 9.

$

.00

7

7

Subtract Line 6 from Line 5.

– 1 5 0 0 0

.00

8

Amount used to reduce the excludable disability income.

$

.00

9

9

Subtract Line 8 from Line 7. If zero or a negative number, stop here. Do not file this form.

$

.00

10

10

Disability income payment excludable. Subtract Line 9 from Line 4.

Enter on D-40 Schedule I, Calculation B, Line 2 (see D-40 instructions). The exclusion may not exceed $5200 per disabled person.

Government of the

2015

Physician’s Certification of Permanent and Total Disability

District of Columbia

Name of disabled taxpayer

Social security number

MM

DD

YY

I certify that the above taxpayer was permanently and totally disabled when the taxpayer retired. (Enter retirement date.)

Physician’s first name, middle initial, last name

Physician’s address (number and street)

Suite number

City

State

Zip Code + 4

Physician’s phone number

Physician’s signature

Date

Attach to Form D-40. See instructions on back.

2015 D-2440 P1

l

l

Revised 11/2015

Disability Income Exclusion

1

1 2

2