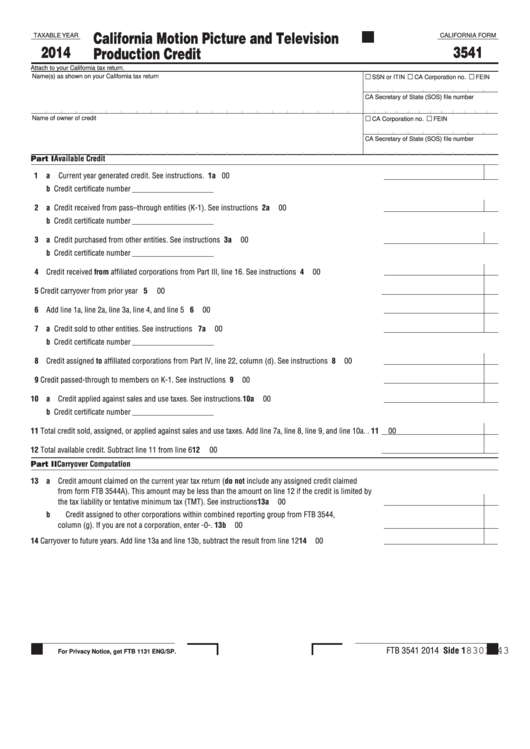

Form 3541 - California Motion Picture And Television Production Credit - 2014

ADVERTISEMENT

California Motion Picture and Television

TAXABLE YEAR

CALIFORNIA FORM

2014

3541

Production Credit

Attach to your California tax return.

Name(s) as shown on your California tax return

SSN or ITIN

CA Corporation no.

FEIN

v

CA Secretary of State (SOS) file number

Name of owner of credit

CA Corporation no.

FEIN

v

CA Secretary of State (SOS) file number

Part I Available Credit

1

a Current year generated credit. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a

00

b Credit certificate number

2 a Credit received from pass–through entities (K-1). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

00

b Credit certificate number

3 a Credit purchased from other entities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3a

00

b Credit certificate number

4 Credit received from affiliated corporations from Part III, line 16. See instructions . . . . . . . . . . . . . . . . . . . . 4

00

5 Credit carryover from prior year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6 Add line 1a, line 2a, line 3a, line 4, and line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

7 a Credit sold to other entities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7a

00

b Credit certificate number

8 Credit assigned to affiliated corporations from Part IV, line 22, column (d). See instructions . . . . . . . . . . . . 8

00

9 Credit passed-through to members on K-1. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

00

10 a Credit applied against sales and use taxes. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10a

00

b Credit certificate number

11 Total credit sold, assigned, or applied against sales and use taxes. Add line 7a, line 8, line 9, and line 10a . .11

00

12 Total available credit. Subtract line 11 from line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12

00

Part II Carryover Computation

13 a Credit amount claimed on the current year tax return (do not include any assigned credit claimed

from form FTB 3544A). This amount may be less than the amount on line 12 if the credit is limited by

the tax liability or tentative minimum tax (TMT). See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13a

00

b Credit assigned to other corporations within combined reporting group from FTB 3544,

column (g). If you are not a corporation, enter -0-. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13b

00

14 Carryover to future years. Add line 13a and line 13b, subtract the result from line 12 . . . . . . . . . . . . . . . . . .14

00

FTB 3541 2014 Side 1

8301143

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5