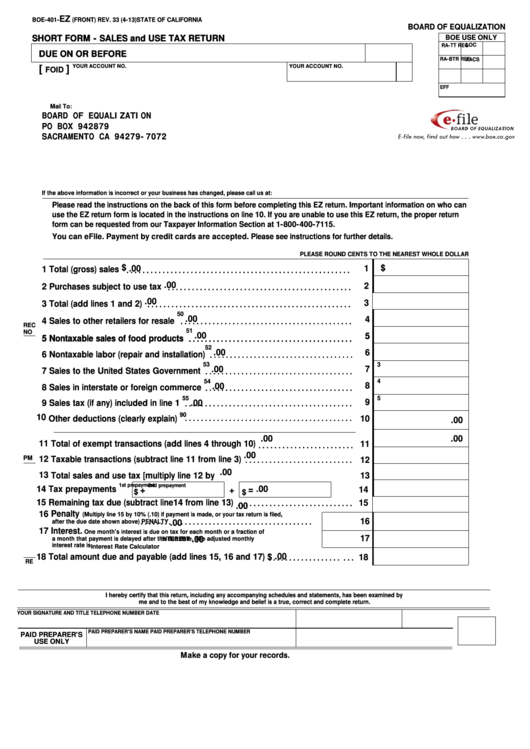

Form Boe-401-Ez - Short Form - Sales And Use Tax Return

ADVERTISEMENT

EZ

BOE-401-

(FRONT) REV. 33 (4-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

SHORT FORM - SALES and USE TAX RETURN

SHORT FORM - SALES and USE TAX RETURN

BOE USE ONLY

LOC

RA-TT

REG

DUE ON OR BEFORE

DUE ON OR BEFORE

RA-BTR

AACS

REF

YOUR ACCOUNT NO.

YOUR ACCOUNT NO.

[

]

FOID

EFF

Mail To:

BOARD OF EQUALIZATION

PO BOX 942879

SACRAMENTO CA 94279-7072

If the above information is incorrect or your business has changed, please call us at:

Please read the instructions on the back of this form before completing this EZ return. Important information on who can

use the EZ return form is located in the instructions on line 10. If you are unable to use this EZ return, the proper return

form can be requested from our Taxpayer Information Section at 1-800-400-7115.

You can eFile. Payment by credit cards are accepted. Please see instructions for further details.

PLEASE ROUND CENTS TO THE NEAREST WHOLE DOLLAR

$

$

1

.00

1 Total (gross) sales

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

2

2 Purchases subject to use tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

3

3 Total (add lines 1 and 2)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

50

4

.00

4 Sales to other retailers for resale

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

REC

51

NO

5

5

.00

5 Nontaxable sales of food products

5 Nontaxable sales of food products

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

52

6

.00

6 Nontaxable labor (repair and installation)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

53

3

7

.00

7 Sales to the United States Government

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

54

4

8

.00

8 Sales in interstate or foreign commerce

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

55

5

9

9 Sales tax (if any) included in line 1

.00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

90

10 Other deductions (clearly explain)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

.00

.00

.00

11 Total of exempt transactions (add lines 4 through 10)

11

. . . . . . . . . . . . . . . . . . . . . . . .

.00

12 Taxable transactions (subtract line 11 from line 3)

PM

12

. . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

13 Total sales and use tax [multiply line 12 by

13

1st prepayment

2nd prepayment

14 Tax prepayments

.00

=

14

+

+

$

$

15 Remaining tax due (subtract line14 from line 13)

15

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

16 Penalty

(Multiply line 15 by 10% (.10) if payment is made, or your tax return is filed,

16

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

after the due date shown above)

PENALTY

.00

17 Interest.

One month's interest is due on tax for each month or a fraction of

17

.00

a month that payment is delayed after the due date. The adjusted monthly

INTEREST

interest rate is

Interest Rate Calculator

.00

18 Total amount due and payable (add lines 15, 16 and 17)

18

$

. . . . . . . . . . . . . . . . . . . . .

RE

I hereby certify that this return, including any accompanying schedules and statements, has been examined by

me and to the best of my knowledge and belief is a true, correct and complete return.

YOUR SIGNATURE AND TITLE

TELEPHONE NUMBER

DATE

PAID PREPARER'S TELEPHONE NUMBER

PAID PREPARER'S NAME

PAID PREPARER'S

USE ONLY

Make a copy for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2