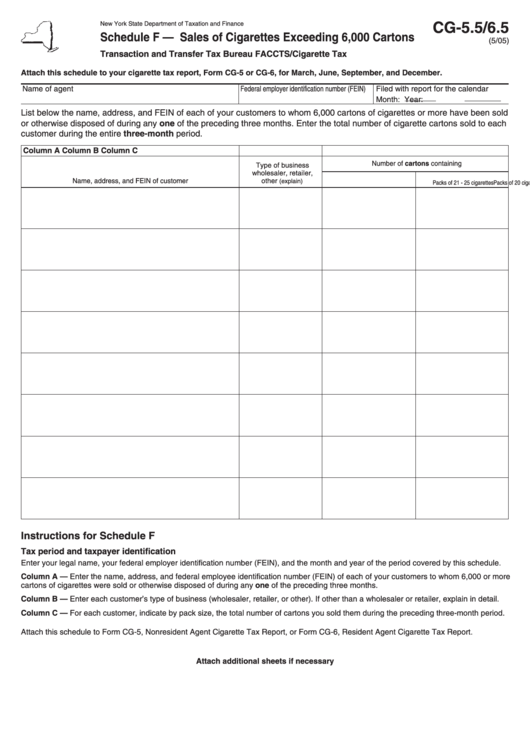

Schedule F (Form Cg-5.5/6.5) - Sales Of Cigarettes Exceeding 6,000 Cartons

ADVERTISEMENT

CG-5.5/6.5

New York State Department of Taxation and Finance

Schedule F — Sales of Cigarettes Exceeding 6,000 Cartons

(5/05)

Transaction and Transfer Tax Bureau FACCTS/Cigarette Tax

Attach this schedule to your cigarette tax report, Form CG-5 or CG-6, for March, June, September, and December.

Name of agent

Federal employer identification number (FEIN)

Filed with report for the calendar

Month:

Year:

List below the name, address, and FEIN of each of your customers to whom 6,000 cartons of cigarettes or more have been sold

or otherwise disposed of during any one of the preceding three months. Enter the total number of cigarette cartons sold to each

customer during the entire three-month period.

Column A

Column B

Column C

Number of cartons containing

Type of business

wholesaler, retailer,

Name, address, and FEIN of customer

other

(explain)

Packs of 20 cigarettes

Packs of 21 - 25 cigarettes

Instructions for Schedule F

Tax period and taxpayer identification

Enter your legal name, your federal employer identification number (FEIN), and the month and year of the period covered by this schedule.

Column A — Enter the name, address, and federal employee identification number (FEIN) of each of your customers to whom 6,000 or more

cartons of cigarettes were sold or otherwise disposed of during any one of the preceding three months.

Column B — Enter each customer’s type of business (wholesaler, retailer, or other). If other than a wholesaler or retailer, explain in detail.

Column C — For each customer, indicate by pack size, the total number of cartons you sold them during the preceding three-month period.

Attach this schedule to Form CG-5, Nonresident Agent Cigarette Tax Report, or Form CG-6, Resident Agent Cigarette Tax Report.

Attach additional sheets if necessary

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1