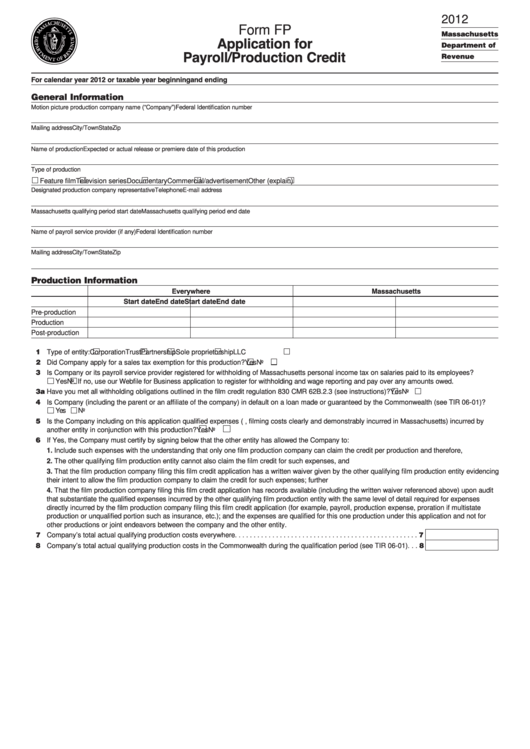

Form Fp - Application For Payroll/production Credit - 2012

ADVERTISEMENT

2012

Form FP

Massachusetts

Application for

Department of

Payroll/Production Credit

Revenue

For calendar year 2012 or taxable year beginning

and ending

General Information

Motion picture production company name (“Company”)

Federal Identification number

Mailing address

City/Town

State

Zip

Name of production

Expected or actual release or premiere date of this production

Type of production

Feature film

Television series

Documentary

Commercial/advertisement

Other (explain)

Designated production company representative

Telephone

E-mail address

Massachusetts qualifying period start date

Massachusetts qualifying period end date

Name of payroll service provider (if any)

Federal Identification number

Mailing address

City/Town

State

Zip

Production Information

Everywhere

Massachusetts

Start date

End date

Start date

End date

Pre-production

Production

Post-production

01 Type of entity:

Corporation

Trust

Partnership

Sole proprietorship

LLC

02 Did Company apply for a sales tax exemption for this production?

Yes

No

03 Is Company or its payroll service provider registered for withholding of Massachusetts personal income tax on salaries paid to its employees?

Yes

No. If no, use our Webfile for Business application to register for withholding and wage reporting and pay over any amounts owed.

03a Have you met all withholding obligations outlined in the film credit regulation 830 CMR 62B.2.3 (see instructions)?

Yes

No

04 Is Company (including the parent or an affiliate of the company) in default on a loan made or guaranteed by the Commonwealth (see TIR 06-01)?

Yes

No

05 Is the Company including on this application qualified expenses (e.g., filming costs clearly and demonstrably incurred in Massachusetts) incurred by

another entity in conjunction with this production?

Yes

No

06 If Yes, the Company must certify by signing below that the other entity has allowed the Company to:

1. Include such expenses with the understanding that only one film production company can claim the credit per production and therefore,

2. The other qualifying film production entity cannot also claim the film credit for such expenses, and

3. That the film production company filing this film credit application has a written waiver given by the other qualifying film production entity evidencing

their intent to allow the film production company to claim the credit for such expenses; further

4. That the film production company filing this film credit application has records available (including the written waiver referenced above) upon audit

that substantiate the qualified expenses incurred by the other qualifying film production entity with the same level of detail required for expenses

directly incurred by the film production company filing this film credit application (for example, payroll, production expense, proration if multistate

production or unqualified portion such as insurance, etc.); and the expenses are qualified for this one production under this application and not for

other productions or joint endeavors between the company and the other entity.

07 Company’s total actual qualifying production costs everywhere . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

08 Company’s total actual qualifying production costs in the Commonwealth during the qualification period (see TIR 06-01) . . . 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4