Form Cg-30.2 - Information Regarding Escrow Deposit - 2014

ADVERTISEMENT

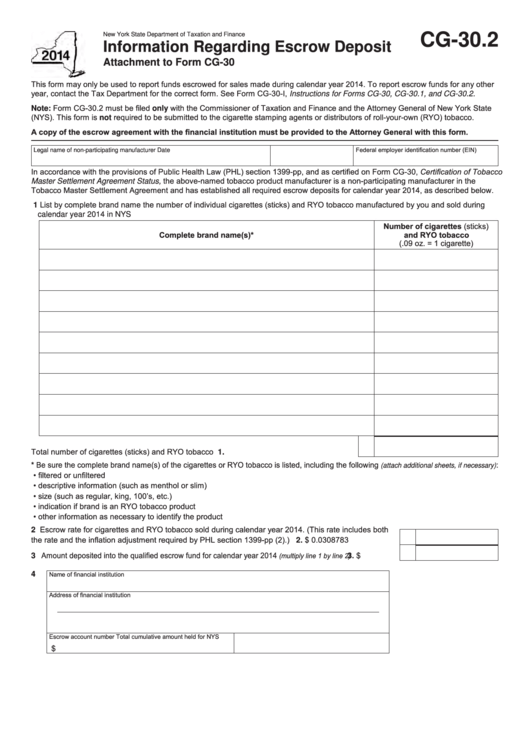

New York State Department of Taxation and Finance

CG-30.2

Information Regarding Escrow Deposit

Attachment to Form CG-30

This form may only be used to report funds escrowed for sales made during calendar year 2014. To report escrow funds for any other

year, contact the Tax Department for the correct form. See Form CG-30-I, Instructions for Forms CG-30, CG-30.1, and CG-30.2.

Note: Form CG-30.2 must be filed only with the Commissioner of Taxation and Finance and the Attorney General of New York State

(NYS). This form is not required to be submitted to the cigarette stamping agents or distributors of roll-your-own (RYO) tobacco.

A copy of the escrow agreement with the financial institution must be provided to the Attorney General with this form.

Federal employer identification number (EIN)

Legal name of non-participating manufacturer

Date

In accordance with the provisions of Public Health Law (PHL) section 1399-pp, and as certified on Form CG-30, Certification of Tobacco

Master Settlement Agreement Status, the above-named tobacco product manufacturer is a non-participating manufacturer in the

Tobacco Master Settlement Agreement and has established all required escrow deposits for calendar year 2014, as described below.

1 List by complete brand name the number of individual cigarettes (sticks) and RYO tobacco manufactured by you and sold during

calendar year 2014 in NYS

Number of cigarettes (sticks)

Complete brand name(s)*

and RYO tobacco

(.09 oz. = 1 cigarette)

Total number of cigarettes (sticks) and RYO tobacco ..............................................................

1.

* Be sure the complete brand name(s) of the cigarettes or RYO tobacco is listed, including the following

:

(attach additional sheets, if necessary)

• filtered or unfiltered

• descriptive information (such as menthol or slim)

• size (such as regular, king, 100’s, etc.)

• indication if brand is an RYO tobacco product

• other information as necessary to identify the product

2 Escrow rate for cigarettes and RYO tobacco sold during calendar year 2014. (This rate includes both

the rate and the inflation adjustment required by PHL section 1399-pp (2).) .......................................... 2.

$ 0.0308783

3 Amount deposited into the qualified escrow fund for calendar year 2014

...................... 3.

(multiply line 1 by line 2)

$

Name of financial institution

4

Address of financial institution

Escrow account number

Total cumulative amount held for NYS

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1