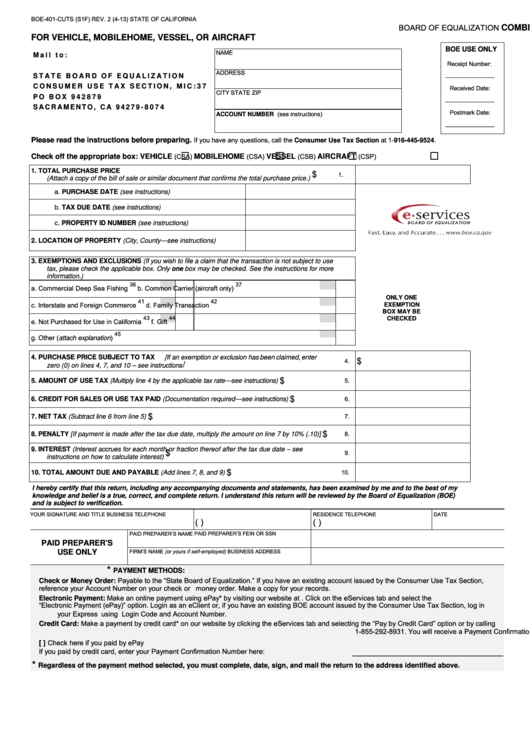

BOE-401-CUTS (S1F) REV. 2 (4-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

COMBINED STATE AND LOCAL CONSUMER USE TAX RETURN

FOR VEHICLE, MOBILEHOME, VESSEL, OR AIRCRAFT

BOE USE ONLY

NAME

M a i l t o :

Receipt Number:

ADDRESS

_______________

S T A T E B O A R D O F E Q U A L I Z A T I O N

C O N S U M E R U S E T A X S E C T I O N , M I C : 3 7

Received Date:

CITY

STATE

ZIP

P O B O X 9 4 2 8 7 9

_______________

S A C R A M E N T O , C A 9 4 2 7 9 - 8 0 7 4

Postmark Date:

ACCOUNT NUMBER (see instructions)

_______________

.

If you have any questions, call the Consumer Use Tax Section at 1-916-445-9524

Please read the instructions before preparing.

(CSA)

(CSA)

(CSB)

(CSP)

Check off the appropriate box:

VEHICLE

MOBILEHOME

VESSEL

AIRCRAFT

1.

TOTAL PURCHASE PRICE

$

1.

(Attach a copy of the bill of sale or similar document that confirms the total purchase price.)

a.

PURCHASE DATE (see instructions)

b.

TAX DUE DATE (see instructions)

c.

PROPERTY ID NUMBER (see instructions)

2.

LOCATION OF PROPERTY (City, County—see instructions)

3.

EXEMPTIONS AND EXCLUSIONS (If you wish to file a claim that the transaction is not subject to use

tax, please check the applicable box. Only one box may be checked. See the instructions for more

information.)

36

37

a.

Commercial Deep Sea Fishing

b.

Common Carrier (aircraft only)

ONLY ONE

41

42

c.

Interstate and Foreign Commerce

d.

Family Transaction

EXEMPTION

BOX MAY BE

43

44

CHECKED

e.

Not Purchased for Use in California

f.

Gift

45

g.

Other (attach explanation)

[

4.

PURCHASE PRICE SUBJECT TO TAX

If an exemption or exclusion has been claimed, enter

$

4.

]

zero (0) on lines 4, 7, and 10 – see instructions

$

5.

5.

AMOUNT OF USE TAX (Multiply line 4 by the applicable tax rate—see instructions)

$

6.

6.

CREDIT FOR SALES OR USE TAX PAID (Documentation required—see instructions)

$

7.

7.

NET TAX (Subtract line 6 from line 5)

$

8.

8.

PENALTY [If payment is made after the tax due date, multiply the amount on line 7 by 10% (.10)]

9.

INTEREST (Interest accrues for each month or fraction thereof after the tax due date – see

$

9.

instructions on how to calculate interest)

$

10.

10. TOTAL AMOUNT DUE AND PAYABLE (Add lines 7, 8, and 9)

I hereby certify that this return, including any accompanying documents and statements, has been examined by me and to the best of my

knowledge and belief is a true, correct, and complete return. I understand this return will be reviewed by the Board of Equalization (BOE)

and is subject to verification.

YOUR SIGNATURE AND TITLE

BUSINESS TELEPHONE

RESIDENCE TELEPHONE

DATE

(

)

(

)

PAID PREPARER’S NAME

PAID PREPARER’S FEIN OR SSN

PAID PREPARER’S

FIRM’S NAME (or yours if self-employed)

BUSINESS ADDRESS

USE ONLY

*

PAYMENT METHODS:

Check or Money Order: Payable to the “State Board of Equalization.” If you have an existing account issued by the Consumer Use Tax Section,

reference your Account Number on your check or

money order. Make a copy for your records.

Electronic Payment: Make an online payment using ePay* by visiting our website at Click on the eServices tab and select the

“Electronic Payment (ePay)” option. Login as an eClient or, if you have an existing BOE account issued by the Consumer Use Tax Section, log in

using

your Express

Login Code and Account Number.

Credit Card: Make a payment by credit card* on our website by clicking the eServices tab and selecting the “Pay by Credit Card” option or by calling

1-855-292-8931. You will receive a Payment Confirmation Number when the transaction is completed.

] Check here if you paid by ePay

[

If you paid by credit card, enter your Payment Confirmation Number here:

______________________

_________________

*

Regardless of the payment method selected, you must complete, date, sign, and mail the return to the address identified above.

1

1 2

2 3

3