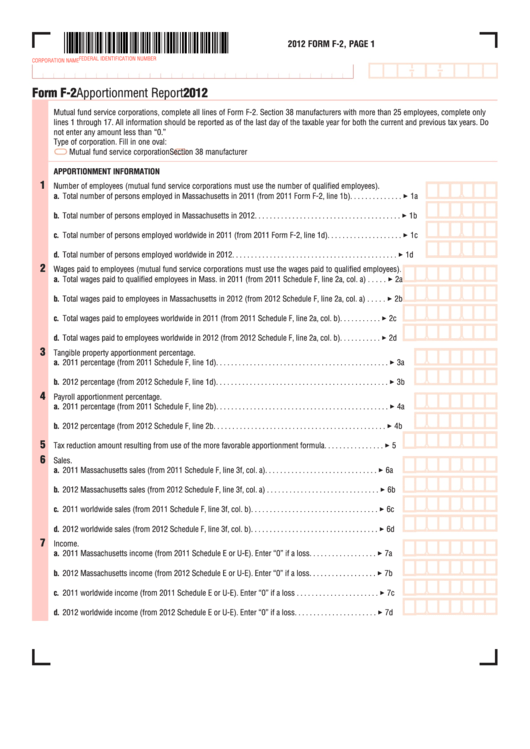

Form F-2 - Apportionment Report - 2012

ADVERTISEMENT

2012 FORM F-2, PAGE 1

FEDERAL IDENTIFICATION NUMBER

CORPORATION NAME

Form F-2 Apportionment Report

2012

Mutual fund service corporations, complete all lines of Form F-2. Section 38 manufacturers with more than 25 employees, complete only

lines 1 through 17. All information should be reported as of the last day of the taxable year for both the current and previous tax years. Do

not enter any amount less than “0.”

Type of corporation. Fill in one oval:

Mutual fund service corporation

Section 38 manufacturer

APPORTIONMENT INFORMATION

1

Number of employees (mutual fund service corporations must use the number of qualified employees).

a. Total number of persons employed in Massachusetts in 2011 (from 2011 Form F-2, line 1b) . . . . . . . . . . . . . . 3 1a

b. Total number of persons employed in Massachusetts in 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1b

c. Total number of persons employed worldwide in 2011 (from 2011 Form F-2, line 1d) . . . . . . . . . . . . . . . . . . . . 3 1c

d. Total number of persons employed worldwide in 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1d

2

Wages paid to employees (mutual fund service corporations must use the wages paid to qualified employees).

a. Total wages paid to qualified employees in Mass. in 2011 (from 2011 Schedule F, line 2a, col. a) . . . . . 3 2a

b. Total wages paid to employees in Massachusetts in 2012 (from 2012 Schedule F, line 2a, col. a) . . . . . 3 2b

c. Total wages paid to employees worldwide in 2011 (from 2011 Schedule F, line 2a, col. b) . . . . . . . . . . . 3 2c

d. Total wages paid to employees worldwide in 2012 (from 2012 Schedule F, line 2a, col. b). . . . . . . . . . . 3 2d

3

Tangible property apportionment percentage.

a. 2011 percentage (from 2011 Schedule F, line 1d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3a

b. 2012 percentage (from 2012 Schedule F, line 1d). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3b

4

Payroll apportionment percentage.

a. 2011 percentage (from 2011 Schedule F, line 2b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4a

b. 2012 percentage (from 2012 Schedule F, line 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4b

5

Tax reduction amount resulting from use of the more favorable apportionment formula . . . . . . . . . . . . . . . . 3 5

6

Sales.

a. 2011 Massachusetts sales (from 2011 Schedule F, line 3f, col. a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6a

b. 2012 Massachusetts sales (from 2012 Schedule F, line 3f, col. a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6b

c. 2011 worldwide sales (from 2011 Schedule F, line 3f, col. b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6c

d. 2012 worldwide sales (from 2012 Schedule F, line 3f, col. b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6d

7

Income.

a. 2011 Massachusetts income (from 2011 Schedule E or U-E). Enter “0” if a loss . . . . . . . . . . . . . . . . . . 3 7a

b. 2012 Massachusetts income (from 2012 Schedule E or U-E). Enter “0” if a loss . . . . . . . . . . . . . . . . . . 3 7b

c. 2011 worldwide income (from 2011 Schedule E or U-E). Enter “0” if a loss . . . . . . . . . . . . . . . . . . . . . . 3 7c

d. 2012 worldwide income (from 2012 Schedule E or U-E). Enter “0” if a loss . . . . . . . . . . . . . . . . . . . . . . 3 7d

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3