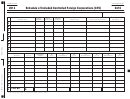

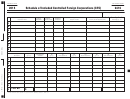

2015 Instructions for Form FTB 2416

Schedule of Included Controlled Foreign Corporations (CFC)

General Information

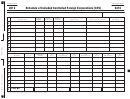

Column (e) – Subpart F income

In determining whether a CFC has Subpart F

A Purpose

income, defined by IRC Section 952, for

purposes of R&TC Section 25110(a)(2) and

Revenue and Taxation Code (R&TC)

the regulations thereunder, the limitation and

Section 25110(a)(2)(A)(ii) provides that

exclusions provided for in IRC Section 954(b)

the income and apportionment factors of

shall apply. However, IRC Section 952(c) shall

any Controlled Foreign Corporation (CFC)

not apply.

(as defined in Internal Revenue Code [IRC]

Section 957) that has Subpart F income

For these purposes, Subpart F income does not

(defined in IRC Section 952) are to be included

include income defined in IRC Sections 955 or

in the combined report of a taxpayer making a

956.

water’s-edge election.

Include both business and nonbusiness

Use form FTB 2416, Schedule of Included

income as defined under R&TC Section 25120

Controlled Foreign Corporations (CFC), to

for the current year.

compute the net income and apportionment

If there is no Subpart F income, none of the

factors required to be included in the

income or factors of this CFC will be included

water’s-edge combined report.

in the water’s-edge combined report. See

Fujitsu IT Holdings, Inc. vs. Franchise Tax Board

B Controlled Foreign

(2004) 120 Cal. App. 4th 459.

Corporation

Column (f) – Current year earnings and profits

In general, a foreign corporation is a

E&P, as defined in IRC Section 964, includes

corporation that is not created or organized in

both business and nonbusiness income for

the U.S. or under the laws of the U.S. or any

the current taxable year. In most cases, the

state.

E&P can be taken from federal Form 5471,

A CFC is any foreign corporation that is more

Information Return of U.S. Persons With

than 50% owned or considered to be owned

Respect To Certain Foreign Corporations,

per IRC Section 958(b) by U.S. shareholders.

page 4, Schedule H, line 5d.

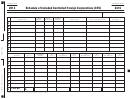

C Apportionment

If there is no current E&P, stop. None of the

income or factors of this CFC will be included

For each CFC, the amounts included in income

in the water’s-edge combined report.

and the apportionment factors are determined

Column (g) – Percentage

by multiplying the total income and each

component of the apportionment factors

The percentage may not exceed 100% or be

by a fraction. The numerator of the fraction

less than zero.

is the current taxable year total Subpart F

Column (h) – Net income

income defined in IRC Section 952 and the

denominator is the current taxable year

Report the total net income as reflected on the

earnings and profits (E&P) as defined in IRC

CFC’s books and records, adjusted to conform

Section 964.

to California tax law.

See R&TC Section 25110(a)(2) and the related

Column (i) – Net income included in the

regulations for more information.

combined report

Specific Instructions

Enter total from column (i) on Form 100W,

Side 1, line 7a.

Column (b) – Country of incorporation

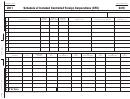

Columns (j), (l), (n), and (p) – Apportionment

Enter the country of incorporation in

factors

column (b). Use the list of country codes on

form FTB 2416, Side 2.

Determine the apportionment factors for

the CFC to be included in the water’s-edge

Column (c) – Country of primary business

combined report including:

activity

• Total sales everywhere, if using the

Enter the country in which the CFC conducts its

single-sales factor formula, or

primary trade or business in column (c). Use

• Total average property everywhere, rent

the list of country codes on form FTB 2416,

expense everywhere, payroll everywhere,

Side 2. This country may be different from the

and sales everywhere, if using the

country of incorporation.

three-factor formula.

Column (d) – Principal business activity

Refer to the apportionment factor rules set

(PBA) code

forth in R&TC Sections 25128.7, 25128,

and 25129 through 25137. See California

Enter the PBA code of the CFC. The PBA codes

Schedule R, Apportionment and Allocation

are listed on the Principal Business Activity

of Income, for more information.

Codes chart included in this booklet.

Page 38 Form 100W Booklet 2015

1

1 2

2 3

3