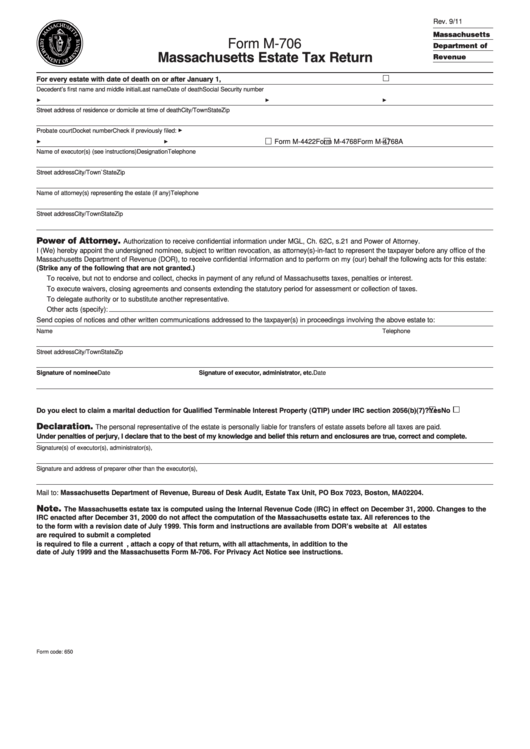

Rev. 9/11

Massachusetts

Form M-706

Department of

Massachusetts Estate Tax Return

Revenue

For every estate with date of death on or after January 1, 2003.

Check if an amended return

Decedent’s first name and middle initial

Last name

Date of death

Social Security number

3

3

3

Street address of residence or domicile at time of death

City/Town

State

Zip

Probate court

Docket number

Check if previously filed:

3

Form M-4422

Form M-4768

Form M-4768A

3

3

Name of executor(s) (see instructions)

Designation

Telephone

Street address

City/Town`

State

Zip

Name of attorney(s) representing the estate (if any)

Telephone

Street address

City/Town

State

Zip

Power of Attorney.

Authorization to receive confidential information under MGL, Ch. 62C, s.21 and Power of Attorney.

I (We) hereby appoint the undersigned nominee, subject to written revocation, as attorney(s)-in-fact to represent the taxpayer before any office of the

Massachusetts Department of Revenue (DOR), to receive confidential information and to perform on my (our) behalf the following acts for this estate:

(Strike any of the following that are not granted.)

To receive, but not to endorse and collect, checks in payment of any refund of Massachusetts taxes, penalties or interest.

To execute waivers, closing agreements and consents extending the statutory period for assessment or collection of taxes.

To delegate authority or to substitute another representative.

Other acts (specify):

Send copies of notices and other written communications addressed to the taxpayer(s) in proceedings involving the above estate to:

Name

Telephone

Street address

City/Town

State

Zip

Signature of nominee

Date

Signature of executor, administrator, etc. Date

Do you elect to claim a marital deduction for Qualified Terminable Interest Property (QTIP) under IRC section 2056(b)(7)?

Yes

No

Declaration.

The personal representative of the estate is personally liable for transfers of estate assets before all taxes are paid.

Under penalties of perjury, I declare that to the best of my knowledge and belief this return and enclosures are true, correct and complete.

Signature(s) of executor(s), administrator(s), etc.

Date

Signature and address of preparer other than the executor(s), etc.

PTIN or SSN

Date

Mail to: Massachusetts Department of Revenue, Bureau of Desk Audit, Estate Tax Unit, PO Box 7023, Boston, MA 02204.

Note.

The Massachusetts estate tax is computed using the Internal Revenue Code (IRC) in effect on December 31, 2000. Changes to the

IRC enacted after December 31, 2000 do not affect the computation of the Massachusetts estate tax. All references to the U.S. Form 706 are

to the form with a revision date of July 1999. This form and instructions are available from DOR’s website at All estates

are required to submit a completed U.S. Form 706 with a revision date of July 1999 in addition to the Massachusetts Form M-706. If the estate

is required to file a current U.S. Form 706, attach a copy of that return, with all attachments, in addition to the U.S. Form 706 with a revision

date of July 1999 and the Massachusetts Form M-706. For Privacy Act Notice see instructions.

Form code: 650

1

1 2

2