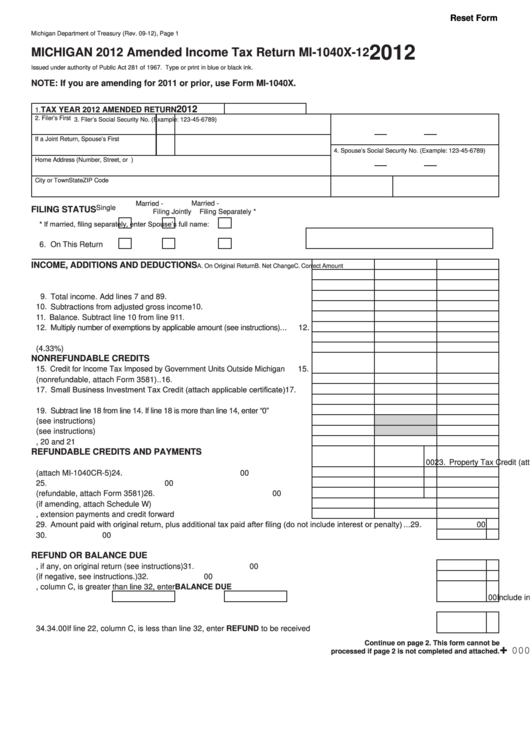

Reset Form

Michigan Department of Treasury (Rev. 09-12), Page 1

2012

MICHIGAN 2012 Amended Income Tax Return MI-1040X-12

Issued under authority of Public Act 281 of 1967. Type or print in blue or black ink.

NOTE: If you are amending for 2011 or prior, use Form MI-1040X.

2012

TAX YEAR 2012 AMENDED RETURN

1.

2. Filer’s First Name

M.I.

Last Name

3. Filer’s Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

4. Spouse’s Social Security No. (Example: 123-45-6789)

Home Address (Number, Street, or P.O. Box)

City or Town

State

ZIP Code

Married -

Married -

Single

FILING STATUS

Filing Jointly

Filing Separately *

* If married, filing separately, enter Spouse’s full name:

5. On Original Return

................

.....................

6. On This Return

................

.....................

INCOME, ADDITIONS AND DEDUCTIONS

A. On Original Return

B. Net Change

C. Correct Amount

7. Adjusted gross income. Explain changes on line 39 ...........................

7.

8. Additions to adjusted gross income .....................................................

8.

9. Total income. Add lines 7 and 8 ...........................................................

9.

10. Subtractions from adjusted gross income ...........................................

10.

11. Balance. Subtract line 10 from line 9 ...................................................

11.

12. Multiply number of exemptions by applicable amount (see instructions)...

12.

13. Taxable income. Subtract line 12 from line 11 .....................................

13.

14. Tax. Multiply line 13 by tax rate (4.33%) ..............................................

14.

NONREFUNDABLE CREDITS

15. Credit for Income Tax Imposed by Government Units Outside Michigan

15.

16. Historic Preservation Tax Credit (nonrefundable, attach Form 3581) ..

16.

17. Small Business Investment Tax Credit (attach applicable certificate)

17.

18. Total nonrefundable credits. Add lines 15 through 17 .........................

18.

19. Subtract line 18 from line 14. If line 18 is more than line 14, enter “0” ........

19.

20. Voluntary Contributions (see instructions) ...........................................

20.

21. Use tax due (see instructions) .............................................................

21.

22. Add lines 19, 20 and 21 .......................................................................

22.

REFUNDABLE CREDITS AND PAYMENTS

23. Property Tax Credit (attach MI-1040CR or MI-1040CR-2) ...................

23.

00

24. Farmland Preservation Credit (attach MI-1040CR-5) ..........................

24.

00

25. Michigan Earned Income Tax Credit ....................................................

25.

00

26. Historic Preservation Tax Credit (refundable, attach Form 3581) ........

26.

00

27. Michigan tax withheld (if amending, attach Schedule W) ....................

27.

28. Estimated tax, extension payments and credit forward .......................

28.

29. Amount paid with original return, plus additional tax paid after filing (do not include interest or penalty) ...

29.

00

30. Total refundable credits and payments. Add lines 23 through 29 of column C ............................................

30.

00

REFUND OR BALANCE DUE

31. Overpayment, if any, on original return (see instructions) ...........................................................................

31.

00

32. Subtract line 31 from line 30 (if negative, see instructions.) ........................................................................

32.

00

33. If line 22, column C, is greater than line 32, enter BALANCE DUE

Include interest

and penalty

(if applicable, see instructions) .......

33.

00

34.

If line 22, column C, is less than line 32, enter REFUND to be received ....................................................

34.

00

Continue on page 2. This form cannot be

+

0000 2012 10 01 27 4

processed if page 2 is not completed and attached.

1

1 2

2 3

3 4

4