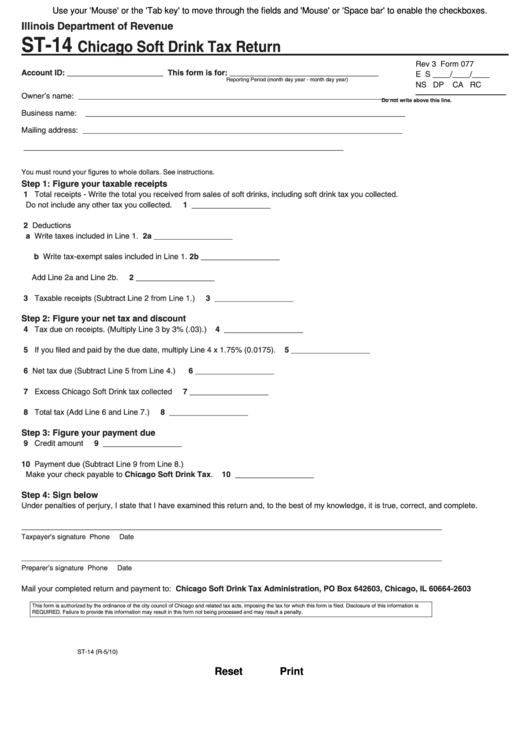

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

ST-14

Chicago Soft Drink Tax Return

Rev 3 Form 077

Account ID: ______________________ This form is for: __________________________________

E S ____/____/____

Reporting Period (month day year - month day year)

NS DP

CA RC

Owner’s name:

_________________________________________________________________________

Do not write above this line.

Business name: _________________________________________________________________________

Mailing address: _________________________________________________________________________

_________________________________________________________________________

You must round your figures to whole dollars. See instructions.

Step 1: Figure your taxable receipts

1

Total receipts - Write the total you received from sales of soft drinks, including soft drink tax you collected.

Do not include any other tax you collected.

1

__________________

2

Deductions

a

2a __________________

Write taxes included in Line 1.

b

Write tax-exempt sales included in Line 1.

2b __________________

Add Line 2a and Line 2b.

2

__________________

3

3

Taxable receipts (Subtract Line 2 from Line 1.)

__________________

Step 2: Figure your net tax and discount

4

4

Tax due on receipts. (Multiply Line 3 by 3% (.03).)

__________________

5

5

If you filed and paid by the due date, multiply Line 4 x 1.75% (0.0175).

__________________

6

Net tax due (Subtract Line 5 from Line 4.)

6

__________________

7

Excess Chicago Soft Drink tax collected

7

__________________

8

8

Total tax (Add Line 6 and Line 7.)

__________________

Step 3: Figure your payment due

9

Credit amount

9

__________________

10 Payment due (Subtract Line 9 from Line 8.)

Make your check payable to Chicago Soft Drink Tax.

10

__________________

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

________________________________________________________________________________________________

Taxpayer’s signature

Phone

Date

________________________________________________________________________________________________

Preparer’s signature

Phone

Date

Mail your completed return and payment to: Chicago Soft Drink Tax Administration, PO Box 642603, Chicago, IL 60664-2603

This form is authorized by the ordinance of the city council of Chicago and related tax acts. imposing the tax for which this form is filed. Disclosure of this information is

REQUIRED. Failure to provide this information may result in this form not being processed and may result a penalty.

ST-14 (R-5/10)

Print

Reset

1

1