Reset Form

Michigan Department of Treasury (Rev. 01-13), Page 1

Issued under authority of Public Act 281 of 1967.

Type or print in blue or black ink.

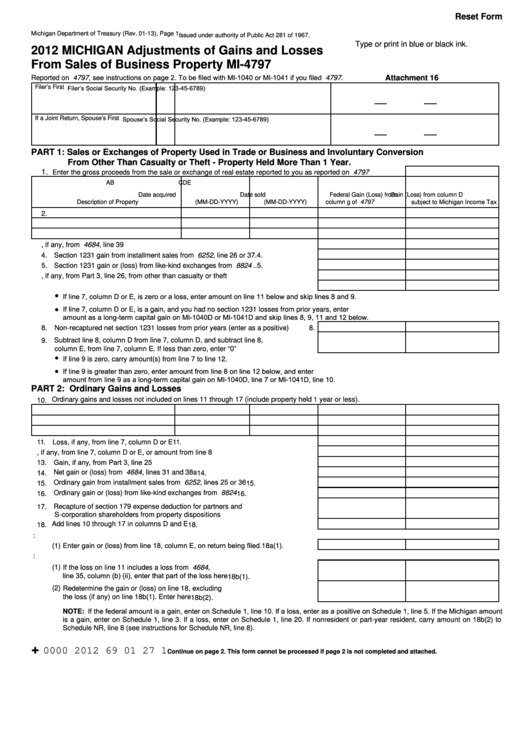

2012 MICHIGAN Adjustments of Gains and Losses

From Sales of Business Property MI-4797

Reported on U.S. Form 4797, see instructions on page 2. To be filed with MI-1040 or MI-1041 if you filed U.S. Form 4797.

Attachment 16

Filer’s Social Security No. (Example: 123-45-6789)

Filer’s First Name

M.I.

Last Name

Spouse’s Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

PART 1: Sales or Exchanges of Property Used in Trade or Business and Involuntary Conversion

From Other Than Casualty or Theft - Property Held More Than 1 Year.

1.

Enter the gross proceeds from the sale or exchange of real estate reported to you as reported on U.S. Form 4797

A

B

C

D

E

Date acquired

Date sold

Federal Gain (Loss) from

Gain (Loss) from column D

Description of Property

(MM-DD-YYYY)

(MM-DD-YYYY)

column g of U.S. Form 4797

subject to Michigan Income Tax

2.

3. Gain, if any, from U.S. Form 4684, line 39 ......................................................

3.

4. Section 1231 gain from installment sales from U.S. Form 6252, line 26 or 37.

4.

5. Section 1231 gain or (loss) from like-kind exchanges from U.S. Form 8824 ..

5.

6. Gain, if any, from Part 3, line 26, from other than casualty or theft .................

6.

7. Add lines 2 through 6 in columns D and E ......................................................

7.

•

If line 7, column D or E, is zero or a loss, enter amount on line 11 below and skip lines 8 and 9.

•

If line 7, column D or E, is a gain, and you had no section 1231 losses from prior years, enter

amount as a long-term capital gain on MI-1040D or MI-1041D and skip lines 8, 9, 11 and 12 below.

8. Non-recaptured net section 1231 losses from prior years (enter as a positive)

8.

9. Subtract line 8, column D from line 7, column D, and subtract line 8,

column E, from line 7, column E. If less than zero, enter “0” ...........................

9.

•

If line 9 is zero, carry amount(s) from line 7 to line 12.

•

If line 9 is greater than zero, enter amount from line 8 on line 12 below, and enter

amount from line 9 as a long-term capital gain on MI-1040D, line 7 or MI-1041D, line 10.

PART 2: Ordinary Gains and Losses

10. Ordinary gains and losses not included on lines 11 through 17 (include property held 1 year or less).

11. Loss, if any, from line 7, column D or E ...........................................................

11.

12. Gain, if any, from line 7, column D or E, or amount from line 8 .......................

12.

13. Gain, if any, from Part 3, line 25 ......................................................................

13.

14. Net gain or (loss) from U.S. Form 4684, lines 31 and 38a ..............................

14.

15. Ordinary gain from installment sales from U.S. Form 6252, lines 25 or 36 .....

15.

16. Ordinary gain or (loss) from like-kind exchanges from U.S. Form 8824..........

16.

17. Recapture of section 179 expense deduction for partners and

S-corporation shareholders from property dispositions ...................................

17.

18. Add lines 10 through 17 in columns D and E ..................................................

18.

18a. For all except individual returns:

(1) Enter gain or (loss) from line 18, column E, on return being filed.

18a(1).

18b. For individual returns:

(1) If the loss on line 11 includes a loss from U.S. Form 4684,

line 35, column (b) (ii), enter that part of the loss here .......................

18b(1).

(2) Redetermine the gain or (loss) on line 18, excluding

the loss (if any) on line 18b(1). Enter here .........................................

18b(2).

NOTE: If the federal amount is a gain, enter on Schedule 1, line 10. If a loss, enter as a positive on Schedule 1, line 5. If the Michigan amount

is a gain, enter on Schedule 1, line 3. If a loss, enter on Schedule 1, line 20. If nonresident or part-year resident, carry amount on 18b(2) to

Schedule NR, line 8 (see instructions for Schedule NR, line 8).

+

0000 2012 69 01 27 1

Continue on page 2. This form cannot be processed if page 2 is not completed and attached.

1

1 2

2