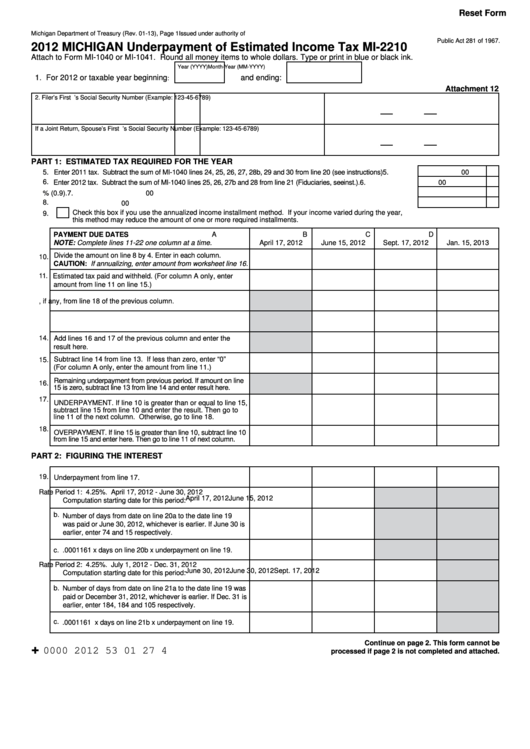

Reset Form

Michigan Department of Treasury (Rev. 01-13), Page 1

Issued under authority of

Public Act 281 of 1967.

2012 MICHIGAN Underpayment of Estimated Income Tax MI-2210

Attach to Form MI-1040 or MI-1041. Round all money items to whole dollars. Type or print in blue or black ink.

Year (YYYY)

Month-Year (MM-YYYY)

1. For 2012 or taxable year beginning

and ending:

:

Attachment 12

2. Filer’s First Name

M.I.

Last Name

3. Filer’s Social Security Number (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

4. Spouse’s Social Security Number (Example: 123-45-6789)

PART 1: ESTIMATED TAX REQUIRED FOR THE YEAR

5. Enter 2011 tax. Subtract the sum of MI-1040 lines 24, 25, 26, 27, 28b, 29 and 30 from line 20 (see instructions) ............

5.

00

6. Enter 2012 tax. Subtract the sum of MI-1040 lines 25, 26, 27b and 28 from line 21 (Fiduciaries, see inst.). .......................

6.

00

7. Multiply amount on line 6 by 90% (0.9). ......................................................................................................................

7.

00

8. Compare the amount on lines 5 and 7. Enter the smaller number. ............................................................................. 8.

00

Check this box if you use the annualized income installment method. If your income varied during the year,

9.

this method may reduce the amount of one or more required installments.

PAYMENT DUE DATES

A

B

C

D

NOTE: Complete lines 11-22 one column at a time.

April 17, 2012

June 15, 2012

Sept. 17, 2012

Jan. 15, 2013

10. Divide the amount on line 8 by 4. Enter in each column.

CAUTION: If annualizing, enter amount from worksheet line 16.

11. Estimated tax paid and withheld. (For column A only, enter

amount from line 11 on line 15.)

12. Enter amount, if any, from line 18 of the previous column.

13. Add lines 11 and 12.

14. Add lines 16 and 17 of the previous column and enter the

result here.

15. Subtract line 14 from line 13. If less than zero, enter “0”

(For column A only, enter the amount from line 11.)

16. Remaining underpayment from previous period. If amount on line

15 is zero, subtract line 13 from line 14 and enter result here.

17.

UNDERPAYMENT. If line 10 is greater than or equal to line 15,

subtract line 15 from line 10 and enter the result. Then go to

line 11 of the next column. Otherwise, go to line 18.

18.

OVERPAYMENT. If line 15 is greater than line 10, subtract line 10

from line 15 and enter here. Then go to line 11 of next column.

PART 2: FIGURING THE INTEREST

19. Underpayment from line 17.

20. a. Rate Period 1: 4.25%. April 17, 2012 - June 30, 2012

April 17, 2012

June 15, 2012

Computation starting date for this period:

b. Number of days from date on line 20a to the date line 19

was paid or June 30, 2012, whichever is earlier. If June 30 is

earlier, enter 74 and 15 respectively.

c. .0001161 x days on line 20b x underpayment on line 19.

21. a. Rate Period 2: 4.25%. July 1, 2012 - Dec. 31, 2012

June 30, 2012

June 30, 2012

Sept. 17, 2012

Computation starting date for this period:

b. Number of days from date on line 21a to the date line 19 was

paid or December 31, 2012, whichever is earlier. If Dec. 31 is

earlier, enter 184, 184 and 105 respectively.

c. .0001161 x days on line 21b x underpayment on line 19.

Continue on page 2. This form cannot be

+

0000 2012 53 01 27 4

processed if page 2 is not completed and attached.

1

1 2

2 3

3 4

4