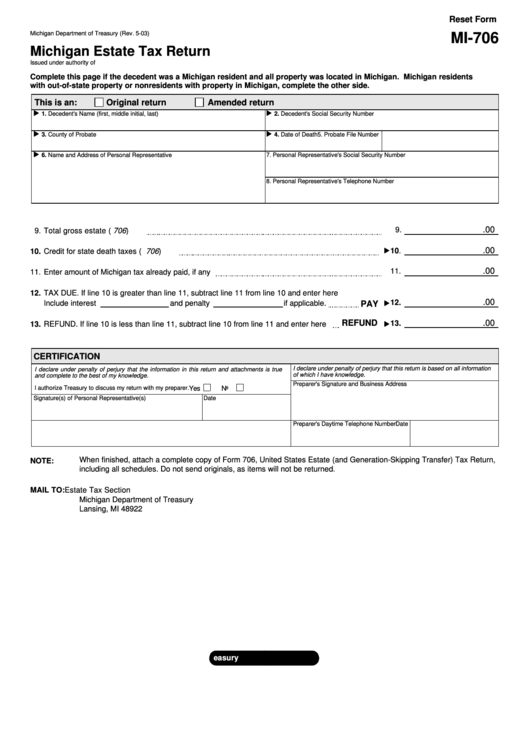

Reset Form

Michigan Department of Treasury (Rev. 5-03)

MI-706

Michigan Estate Tax Return

Issued under authority of P.A. 54 of 1993. Filing is mandatory.

Complete this page if the decedent was a Michigan resident and all property was located in Michigan. Michigan residents

with out-of-state property or nonresidents with property in Michigan, complete the other side.

This is an:

Original return

Amended return

.

.

1. Decedent's Name (first, middle initial, last)

2. Decedent's Social Security Number

.

.

3. County of Probate

4. Date of Death

5. Probate File Number

.

6. Name and Address of Personal Representative

7. Personal Representative's Social Security Number

8. Personal Representative's Telephone Number

.00

9.

9.

Total gross estate (U.S. 706)

.

.00

10.

10.

Credit for state death taxes (U.S. 706)

.00

11.

11.

Enter amount of Michigan tax already paid, if any

12.

TAX DUE. If line 10 is greater than line 11, subtract line 11 from line 10 and enter here

.

.00

12.

Include interest

and penalty

if applicable.

PAY

REFUND

.

.00

13.

13.

REFUND. If line 10 is less than line 11, subtract line 10 from line 11 and enter here

CERTIFICATION

I declare under penalty of perjury that this return is based on all information

I declare under penalty of perjury that the information in this return and attachments is true

of which I have knowledge.

and complete to the best of my knowledge.

Preparer's Signature and Business Address

I authorize Treasury to discuss my return with my preparer.

Yes

No

Signature(s) of Personal Representative(s)

Date

Preparer's Daytime Telephone Number

Date

When finished, attach a complete copy of Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return,

NOTE:

including all schedules. Do not send originals, as items will not be returned.

MAIL TO:

Estate Tax Section

Michigan Department of Treasury

Lansing, MI 48922

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9