Supplement To Withholding Tables Booklet - 2013 Maine Income Tax Withholding Percentage Method

ADVERTISEMENT

SUPPLEMENT TO WITHHOLDING TABLES BOOKLET

2013 MAINE INCOME TAX WITHHOLDING

PERCENTAGE METHOD

Changes impacting 2013 withholding: Tax laws enacted during the last two legislative sessions result

in lower Maine income tax withholding for most taxpayers beginning in 2013. In particular, three law

changes directly impact the calculation of 2013 Maine income tax withholding amounts:

1) The number of Maine tax rate brackets are reduced from 4 (2%, 4.5%, 7% & 8.5%) to 3 (0%,

6.5% & 7.95%). Note that the new rate structure includes a 0% bracket and that the top rate is

reduced from 8.5% to 7.95%.

2) The 2013 Maine standard deduction amounts conform to the 2013 federal standard deduction

amounts. Thus, in accordance with current federal law, the 2013 Maine standard deduction

amounts are $6,100 for single taxpayers and $10,150 for taxpayers filing married joint.

3) The 2013 Maine personal exemption amount conforms to the 2013 federal personal exemption

amount. As such, the 2013 Maine personal exemption amount is $3,900.

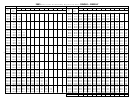

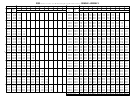

These changes are reflected in the 2013 withholding tax rate schedules and calculations contained in the

pages that follow. If you have any questions about the 2013 schedules and calculations, please call 207

626-8475 (press 1, option 4) or email withholding.tax@maine.gov.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4