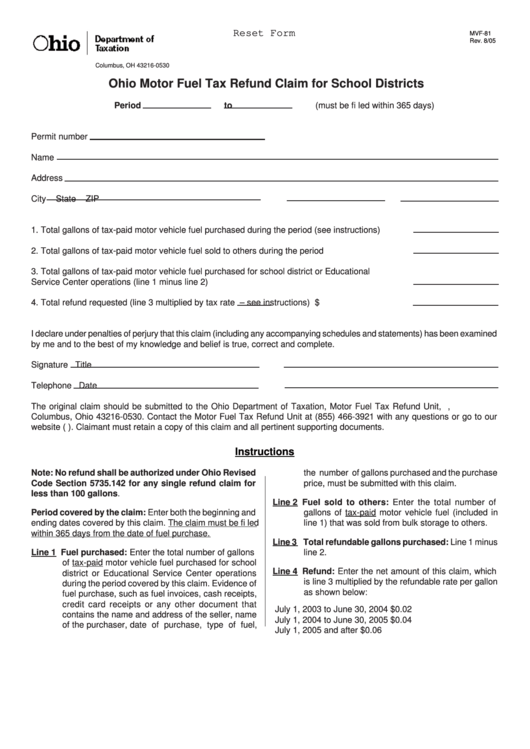

Reset Form

MVF-81

Rev. 8/05

P.O. Box 530

Columbus, OH 43216-0530

Ohio Motor Fuel Tax Refund Claim for School Districts

Period

to

(must be fi led within 365 days)

Permit number

Name

Address

City

State

ZIP

1. Total gallons of tax-paid motor vehicle fuel purchased during the period (see instructions) .........

2. Total gallons of tax-paid motor vehicle fuel sold to others during the period .................................

3. Total gallons of tax-paid motor vehicle fuel purchased for school district or Educational

Service Center operations (line 1 minus line 2) ............................................................................

4. Total refund requested (line 3 multiplied by tax rate

– see instructions) ......................... $

I declare under penalties of perjury that this claim (including any accompanying schedules and statements) has been examined

by me and to the best of my knowledge and belief is true, correct and complete.

Signature

Title

Telephone

Date

The original claim should be submitted to the Ohio Department of Taxation, Motor Fuel Tax Refund Unit, P.O. Box 530,

Columbus, Ohio 43216-0530. Contact the Motor Fuel Tax Refund Unit at (855) 466-3921 with any questions or go to our

website (tax.ohio.gov). Claimant must retain a copy of this claim and all pertinent supporting documents.

Instructions

Note: No refund shall be authorized under Ohio Revised

the number of gallons purchased and the purchase

Code Section 5735.142 for any single refund claim for

price, must be submitted with this claim.

less than 100 gallons.

Line 2 Fuel sold to others: Enter the total number of

Period covered by the claim: Enter both the beginning and

gallons of tax-paid motor vehicle fuel (included in

ending dates covered by this claim. The claim must be fi led

line 1) that was sold from bulk storage to others.

within 365 days from the date of fuel purchase.

Line 3 Total refundable gallons purchased: Line 1 minus

Line 1 Fuel purchased: Enter the total number of gallons

line 2.

of tax-paid motor vehicle fuel purchased for school

Line 4 Refund: Enter the net amount of this claim, which

district or Educational Service Center operations

is line 3 multiplied by the refundable rate per gallon

during the period covered by this claim. Evidence of

as shown below:

fuel purchase, such as fuel invoices, cash receipts,

credit card receipts or any other document that

July 1, 2003 to June 30, 2004

$0.02

contains the name and address of the seller, name

July 1, 2004 to June 30, 2005

$0.04

of the purchaser, date of purchase, type of fuel,

July 1, 2005 and after

$0.06

1

1