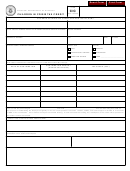

Reset Form

Print Form

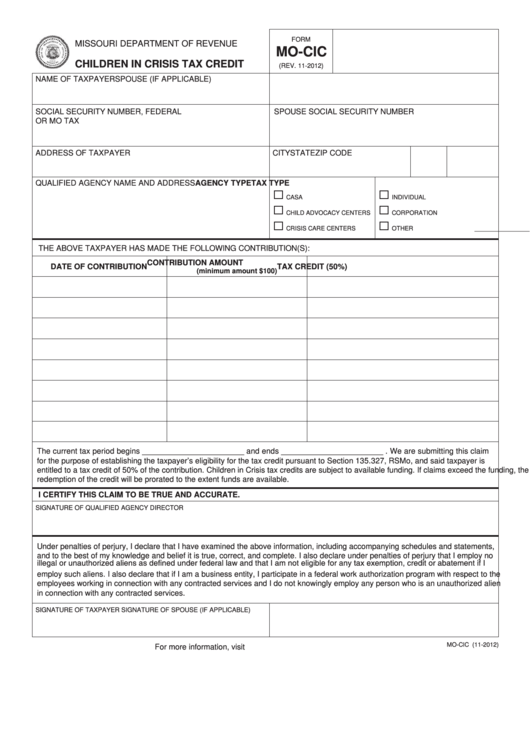

FORM

MISSOURI DEPARTMENT OF REVENUE

MO-CIC

CHILDREN IN CRISIS TAX CREDIT

(REV. 11-2012)

NAME OF TAXPAYER

SPOUSE (IF APPLICABLE)

SOCIAL SECURITY NUMBER, FEDERAL I.D. NUMBER

SPOUSE SOCIAL SECURITY NUMBER

OR MO TAX I.D. NUMBER

ADDRESS OF TAXPAYER

CITY

STATE

ZIP CODE

QUALIFIED AGENCY NAME AND ADDRESS

AGENCY TYPE

TAX TYPE

CASA

INDIVIDUAL

CHILD ADVOCACY CENTERS

CORPORATION

CRISIS CARE CENTERS

OTHER _______________________

THE ABOVE TAXPAYER HAS MADE THE FOLLOWING CONTRIBUTION(S):

CONTRIBUTION AMOUNT

DATE OF CONTRIBUTION

TAX CREDIT (50%)

(minimum amount $100)

The current tax period begins _______________________ and ends _______________________ . We are submitting this claim

for the purpose of establishing the taxpayer’s eligibility for the tax credit pursuant to Section 135.327, RSMo, and said taxpayer is

entitled to a tax credit of 50% of the contribution. Children in Crisis tax credits are subject to available funding. If claims exceed the funding, the

redemption of the credit will be prorated to the extent funds are available.

I CERTIFY THIS CLAIM TO BE TRUE AND ACCURATE.

SIGNATURE OF QUALIFIED AGENCY DIRECTOR

Under penalties of perjury, I declare that I have examined the above information, including accompanying schedules and statements,

and to the best of my knowledge and belief it is true, correct, and complete. I also declare under penalties of perjury that I employ no

illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption, credit or abatement if I

employ such aliens. I also declare that if I am a business entity, I participate in a federal work authorization program with respect to the

employees working in connection with any contracted services and I do not knowingly employ any person who is an unauthorized alien

in connection with any contracted services.

SIGNATURE OF TAXPAYER

SIGNATURE OF SPOUSE (IF APPLICABLE)

MO-CIC (11-2012)

For more information, visit

1

1