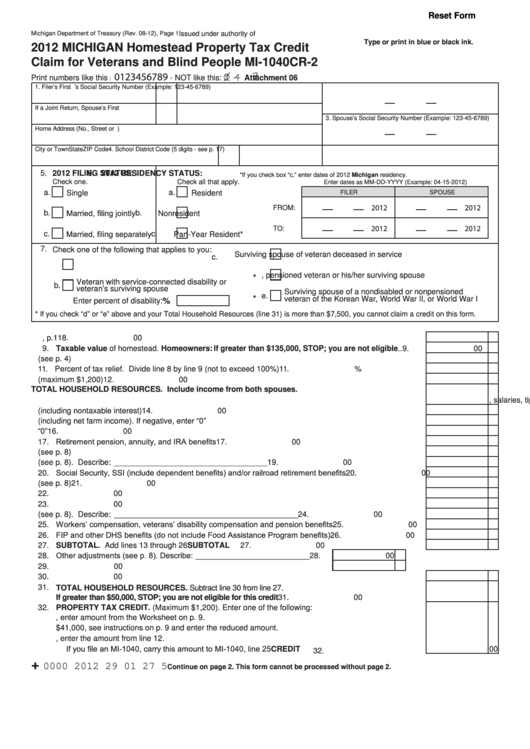

Reset Form

Michigan Department of Treasury (Rev. 08-12), Page 1

Issued under authority of P.A. 281 of 1967.

Type or print in blue or black ink.

2012 MICHIGAN Homestead Property Tax Credit

Claim for Veterans and Blind People MI-1040CR-2

1 4

0123456789

Print numbers like this

- NOT like this:

Attachment 06

:

1. Filer’s First Name

M.I.

Last Name

2. Filer’s Social Security Number (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

3. Spouse’s Social Security Number (Example: 123-45-6789)

Home Address (No., Street or P.O. Box)

City or Town

State

ZIP Code

4. School District Code (5 digits - see p. 17)

5. 2012 FILING STATUS:

6. 2012 RESIDENCY STATUS:

*If you check box “c,” enter dates of 2012 Michigan residency.

Check one.

Check all that apply.

Enter dates as MM-DD-YYYY (Example: 04-15-2012)

a.

a.

Single

Resident

FILER

SPOUSE

2012

2012

FROM:

Married, filing jointly

b.

b.

Nonresident

2012

2012

TO:

Married, filing separately

c.

c.

Part-Year Resident*

7. Check one of the following that applies to you:

Surviving spouse of veteran deceased in service

c.

a.

Blind and own your homestead

* d.

Active military, pensioned veteran or his/her surviving spouse

Veteran with service-connected disability or

b.

veteran’s surviving spouse

Surviving spouse of a nondisabled or nonpensioned

* e.

veteran of the Korean War, World War II, or World War I

%

Enter percent of disability:

* If you check “d” or “e” above and your Total Household Resources (line 31) is more than $7,500, you cannot claim a credit on this form.

8. Taxable value allowance from Table 2, p.11 ...........................................................................................

8.

00

9. Taxable value of homestead. Homeowners: If greater than $135,000, STOP; you are not eligible ..

9.

00

10. Property taxes levied on your home for 2012 (see p. 4).........................................................................

10.

00

11. Percent of tax relief. Divide line 8 by line 9 (not to exceed 100%) ........................................................

11.

%

12. Multiply line 10 by line 11. Enter the result (maximum $1,200) .............................................................

12.

00

TOTAL HOUSEHOLD RESOURCES. Include income from both spouses.

13. Wages, salaries, tips, sick, strike and SUB pay, etc. ..............................................................................

13.

00

14. All interest and dividend income (including nontaxable interest) ............................................................

14.

00

15. Net business income (including net farm income). If negative, enter “0”................................................

15.

00

16. Net royalty or rent income. If negative enter “0” .....................................................................................

16.

00

17. Retirement pension, annuity, and IRA benefits .......................................................................................

17.

00

18. Capital gains less capital losses (see p. 8).............................................................................................

18.

00

19. Alimony and other taxable income (see p. 8). Describe: ___________________________________

19.

00

20. Social Security, SSI (include dependent benefits) and/or railroad retirement benefits ...........................

20.

00

21. Child support and foster parent payments received (see p. 8) ...............................................................

21.

00

22. Unemployment compensation ................................................................................................................

22.

00

23. Gifts or expenses paid on your behalf ....................................................................................................

23.

00

24. Other nontaxable income (see p. 8). Describe: __________________________________________

24.

00

25. Workers’ compensation, veterans’ disability compensation and pension benefits .................................

25.

00

26. FIP and other DHS benefits (do not include Food Assistance Program benefits) ..................................

26.

00

27. SUBTOTAL. Add lines 13 through 26 ................................................................................SUBTOTAL

27.

00

28. Other adjustments (see p. 8). Describe: __________________________

28.

00

29. Medical insurance or HMO premiums you paid for you and your family .....

29.

00

30. Add lines 28 and 29 ................................................................................................................................

30.

00

31. TOTAL HOUSEHOLD RESOURCES. Subtract line 30 from line 27.

If greater than $50,000, STOP; you are not eligible for this credit .........................................................

31.

00

32. PROPERTY TAX CREDIT. (Maximum $1,200). Enter one of the following:

a. FIP/DHS RECIPIENTS, enter amount from the Worksheet on p. 9.

b. If line 31 is more than $41,000, see instructions on p. 9 and enter the reduced amount.

c. ALL OTHERS, enter the amount from line 12.

If you file an MI-1040, carry this amount to MI-1040, line 25............................................... CREDIT

00

32.

+

0000 2012 29 01 27 5

Continue on page 2. This form cannot be processed without page 2.

1

1 2

2