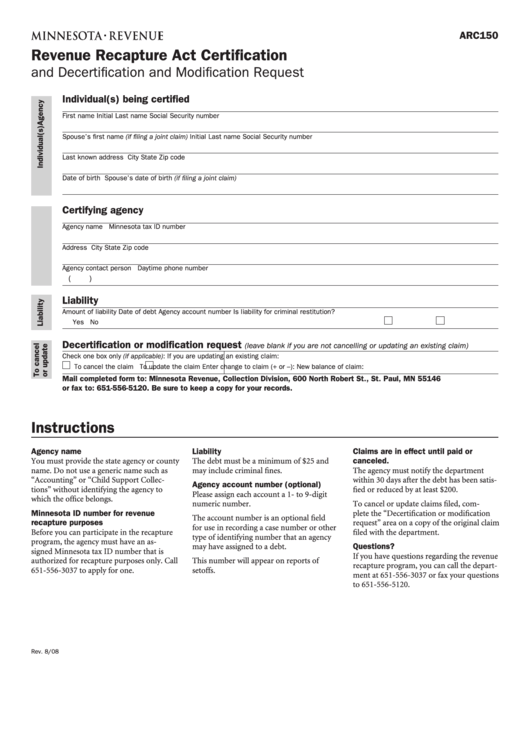

ARC150

Revenue Recapture Act Certification

and Decertification and Modification Request

Individual(s) being certified

First name

Initial

Last name

Social Security number

Spouse’s first name (if filing a joint claim)

Initial

Last name

Social Security number

Last known address

City

State

Zip code

Date of birth

Spouse’s date of birth (if filing a joint claim)

Certifying agency

Agency name

Minnesota tax ID number

Address

City

State

Zip code

Agency contact person

Daytime phone number

(

)

Liability

Amount of liability

Date of debt

Agency account number

Is liability for criminal restitution?

Yes

No

Decertification or modification request

(leave blank if you are not cancelling or updating an existing claim)

Check one box only (if applicable):

If you are updating an existing claim:

To cancel the claim

To update the claim

Enter change to claim (+ or –):

New balance of claim:

Mail completed form to: Minnesota Revenue, Collection Division, 600 North Robert St., St. Paul, MN 55146

or fax to: 651-556-5120. Be sure to keep a copy for your records.

Instructions

Agency name

Liability

Claims are in effect until paid or

canceled.

You must provide the state agency or county

The debt must be a minimum of $25 and

name. Do not use a generic name such as

may include criminal fines.

The agency must notify the department

“Accounting” or “Child Support Collec-

within 30 days after the debt has been satis-

Agency account number (optional)

tions” without identifying the agency to

fied or reduced by at least $200.

Please assign each account a 1- to 9-digit

which the office belongs.

numeric number.

To cancel or update claims filed, com-

Minnesota ID number for revenue

plete the “Decertification or modification

The account number is an optional field

recapture purposes

request” area on a copy of the original claim

for use in recording a case number or other

Before you can participate in the recapture

filed with the department.

type of identifying number that an agency

program, the agency must have an as-

Questions?

may have assigned to a debt.

signed Minnesota tax ID number that is

If you have questions regarding the revenue

authorized for recapture purposes only. Call

This number will appear on reports of

recapture program, you can call the depart-

651-556-3037 to apply for one.

setoffs.

ment at 651-556-3037 or fax your questions

to 651-556-5120.

Rev. 8/08

1

1